ApeCoin price has appreciated by over 40% since Nov. 18, making traders and investors hopeful of a final recovery. However, recent on-chain data paints a different picture of APE price.

While ApeCoin saw an impressive run over the last few weeks, the +17.48% weekly ROI vs. USD tempted many investors to flee. A recent analysis revealed some shocking truths about the ApeCoin treasury that could spell trouble for the token’s price.

Treasury Cashing Out

ApeCoin appeared to be in trouble after on-chain investigators found some unusual transactions by ApeCoin Treasury. Lookonchain, a smart money tracking and on-chain analysis account, recently discovered that the ApeCoin treasury has been selling APE tokens in small amounts.

In a series of tweets, they revealed that a wallet of the ApeCoin treasury transferred 4.6 million APE, worth $19.7 million, in the early hours of Nov. 30. From the looks of it, a considerable amount of APE tokens were distributed among various addresses.

Five ApeCoin Treasury wallets transferred APE to Coinbase, Binance, FTX, and KuCoin through the address “0xa29d” for sale.

In addition, around the same on Wednesday, another four ApeCoin treasury wallets used the same method to sell APE. These wallets sold nearly 20,000 APE worth $85,399.

They transferred 99.8% of the APE to a new address every time and then moved 0.2% of the APE to exchanges for sale.

Besides that, Jeffrey Huang, also known as Machi Big Brother, sold 150,000 APE worth $631,295 at an average selling price of $4.21. The NFT whale has been observed to buy APE at lower price and sell when it pumps.

The massive APE selling that took place recently can significantly impact APE price action.

How Is APE Price Reacting?

APE price was still up by 23.80% on the weekly window, but the recent sell-offs can spell trouble for APE price action. Taking a look at the token’s on-chain metrics can help assess where the price is going in the short term.

The exchange flow balance has maintained in the positive, presenting more exchange inflows which is a bearish trend.

However, active deposits plateauing and inflows dominating it suggest that tokens were being sent to exchanges – a bearish trend.

Over the last week, APE price witnessed an over 40% surge following the release of final staking details and the official ApeCoin NFT marketplace rollout. With the price gaining momentum, many short-term participants could have decided to take profits.

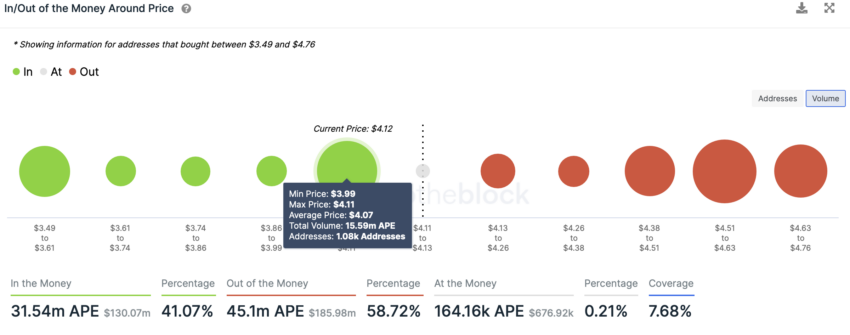

Looking at the In/Out of Money Around the Price indicator for APE, it was clear that while bears loom over price action, the $4.00 mark could offer relief to holders. The $4.07 mark, where 1,080 addresses hold 15.59 million APE tokens, can be a good support level.

However, a pullback below the $4 mark can spell trouble for the token especially after the recent sell-offs.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment