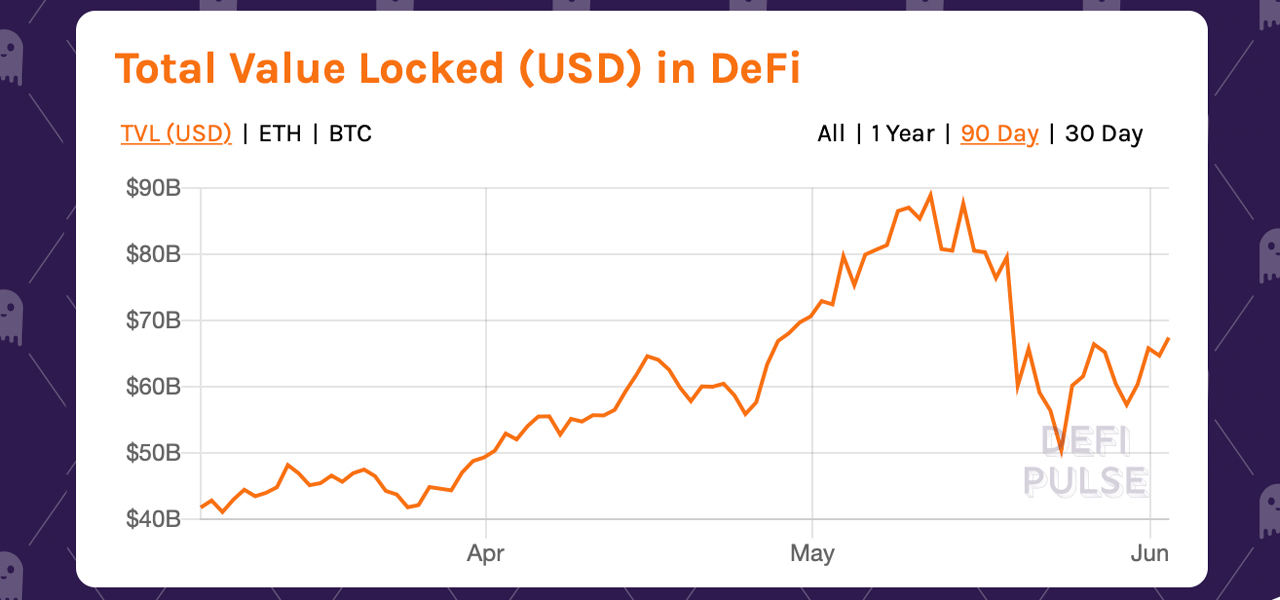

Decentralized finance (defi) exchanges and tokens are recovering a lot faster than a great number of digital assets that lost more than 40% in value last week. Defi tokens like curve, kyber network, terra, hxro, and more have been seeing double-digit gains. On May 23, the defi economy’s aggregate total-value locked (TVL) dropped to a low of around $50 billion and has since gained $17.4 billion.

Defi Economy Lifts Higher Than the Rest

Defi fans are seeing the economy improve a bit after many decentralized finance tokens lost a significant amount of value during the recent market rout. However, the defi economy is picking up steam once again as a myriad of metrics show the ecosystem is healing faster than other crypto assets.

Seven-day statistics for decentralized exchanges (dex) show $19 billion swapped on dex applications like Uniswap, Sushiswap, Curve, 0x Native, and Tokenlon.

Dune Analytics stats show Uniswap saw $11.4 billion in trades while Sushiswap saw $2.4 billion in swaps during the last week. On the Binance Smart Chain (BSC), the popular dex platform Pancakeswap tallied $20.4 million in volume in the last 24 hours.

Binance dex has seen $5.4 million in 24-hour volume while BSC dex apps like Autofarm and Nerve Finance have also seen increased trading action. Coinranking.com’s exchange ratings show Uniswap is ranked 18 out of the top 20 exchanges today.

The defi economy’s TVL has increased by 34.8% since May 23, after the defi TVL slid to $50 billion and jumped back to $67.4 billion, according to data collected on June 2. Defipulse.com records show that Aave has a dominance ranking of 15.18% as the lending protocol has $10.2 billion TVL.

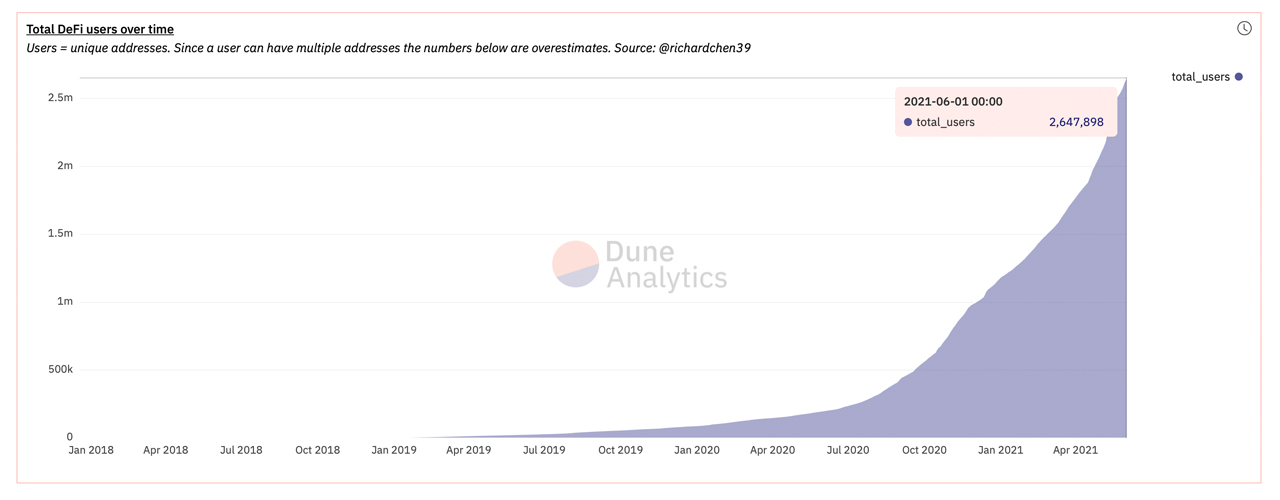

Defi users over time continue to rise exponentially as Dune Analytics indicates there are 2.64 million unique addresses today. Unique defi addresses have grown 124% since December 31, 2020.

Currently, Uniswap is pulling in the most revenue followed by Sushiswap and Aave. As far as TVL data is concerned, following Aave, defi platforms like Maker, Compound, Polygon, and Curve have jumped 7-12%.

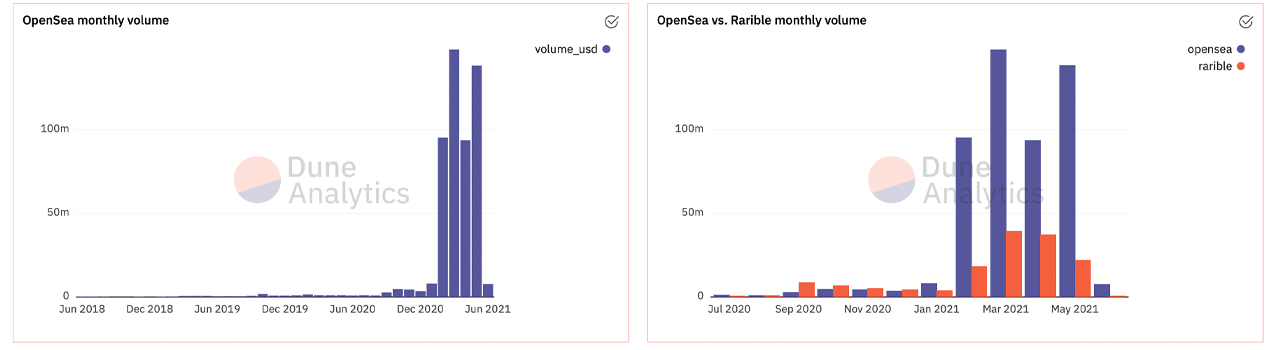

The top non-fungible token (NFT) markets Opensea and Rarible have seen a significant rise in USD volume in May compared to April. Opensea for instance saw $93 million in April and in May volume jumped to $138 million.

Rarible’s volume was slightly higher in April compared to May and Opensea still towers over Rarible in terms of USD volume. Rarible saw $37 million in April and May stats indicate the NFT marketplace saw only $22 million.

What do you think about the current state of the defi ecosystem? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Dune Analytics, Defipulse.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Be the first to comment