This week in crypto news ended with a bang as the U.S. Securities and Exchange Commission (SEC) started tightening its manacles on stablecoins.

It sounded like all-out war was brewing at press time as the agency’s chief, Gary Gensler, hit Kraken with a $30 million fine and ordered the closure of its staking service.

The decision even perplexed SEC commissioner Hester Pierce, who publicly scolded her own agency saying, “using enforcement actions to tell people what the law is in an emerging industry is not an efficient or fair way of regulating.”

And to compound matters, the New York Department of Financial Services (NYDFS) launched an investigation into stablecoin issuer Paxos.

Then the Office of the Comptroller of the Currency (OCC), a federal bank regulator, reputedly asked Paxos to withdraw its application for a national trust bank charter, although the stablecoin issuer refuted the rumors. The effect was Paxos briefly lost parity with the USD

Crypto – Socially Speaking

Confusion Reigns at Binance

Mystery surrounded a decision by Binance to suspend USD withdrawals. A spokesman for the biggest crypto exchange gave no reason. But other payment methods, such as Apple Pay and Google Pay were unaffected.

The move immediately prompted confusion, with the U.S. arm of the business having to explain that the suspension only applied to Binance and not Binance.US. So now that’s clear.

Rumors that a revised relationship with Signature Bank could be at least part of the reason. Supporting this theory is a substantial pullback by Signature to reduce its crypto asset exposure after the collapse of FTX last year.

Crypto Coin News

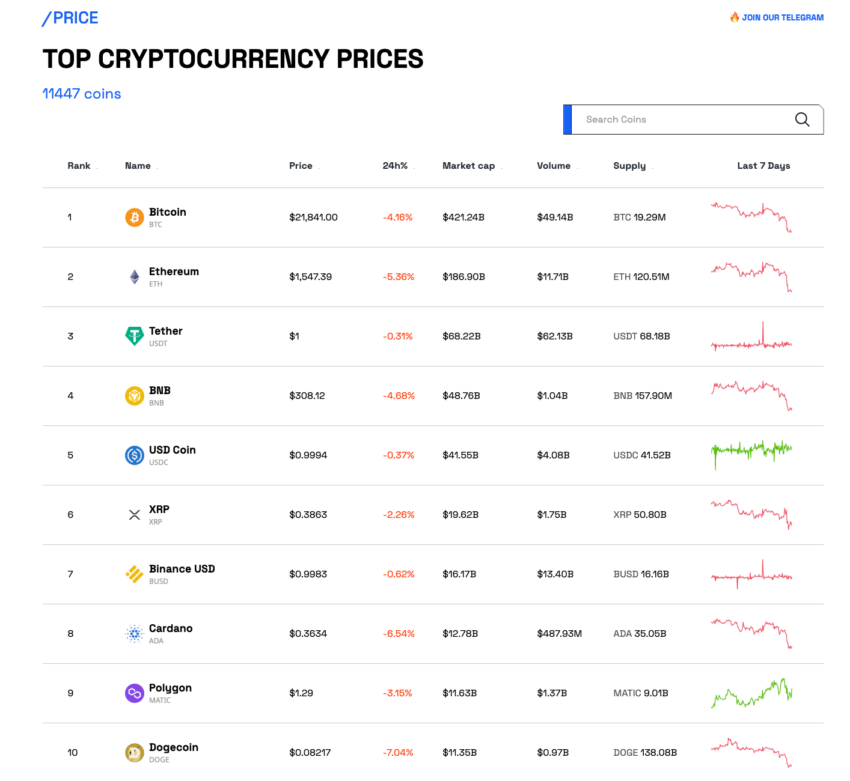

The top gaining cryptocurrency of the past week was SingularityNET (AGIX), which saw a price increase of 133%. The Graph (GRT) made an impressive 64.81%. Meanwhile, at the other end, the biggest loser this week was Fantom (FTM), which saw a 25% fall in price. Aptos (APT) and Terra (LUNA) had an equally dismal week, both falling 21%.

Farewell Old Friend

The news of the demise of the LocalBitcoins exchange caused sadness across the BeInCrypto family.

The Finnish P2P Bitcoin exchange shut up shop after 10 years citing the crypto winter which shrunk its market share and trading volumes.

The exchange was, for many, where they bought their first Bitcoin. And the comments in the Twitter thread below serves as an admirable testimony to their services.

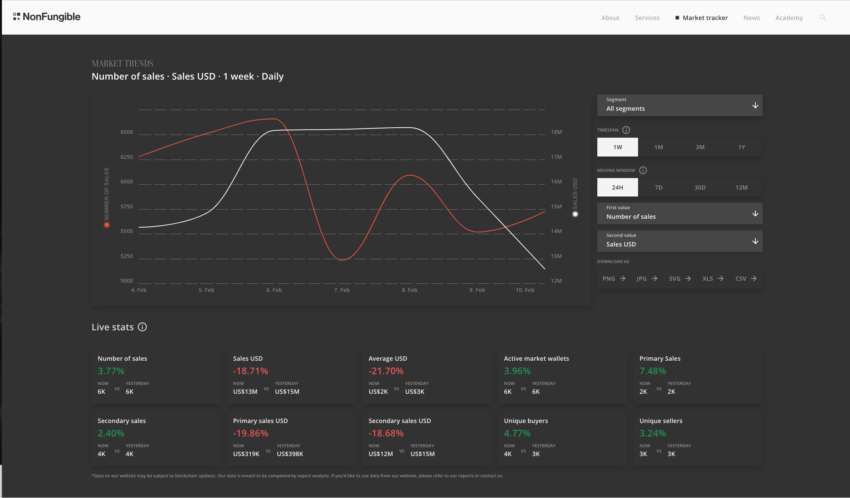

This Week in NFT Sales

The biggest news in the NFT space last week is the meteoric rise of Blur since its launch last Oct. The marketplace is going toe-to-toe with OpenSea for dominance of the space, winning over business with zero trading fees and marketplace “floor sweeping.” And it has now become the second-largest NFT marketplace by volume.

Metaverse Misgivings

It was supposed to be the biggest thing since the last big thing, But for Microsoft, the metaverse has proved to be something of a liability.

The software giant has canned its team of 100 staff after just four months. This particular metaverse team was called the Industrial Metaverse Core and focused on industrial settings. Specifically, it aimed to build interfaces for operating control systems in electrical power plants and robotics and transportation networks, according to The Information.

Microsoft is not the only tech giant to have reigned in its ambitions. Meta announced that it would shut down Crayta, which it purchased less than two years ago. The company is also closing Echo VR, a metaverse game popular in its ecosystem.

A Ripple of Good News?

Senior analyst Valdrin Tahiri see bullish signs this week in the Ripple (XRP) price action.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment