Bitcoin’s blockchain is undergoing a historic transformation, spearheaded by the introduction of the Runes token standard.

This new development enhances the functionality of Bitcoin by enabling the creation of fungible tokens. It also significantly boosts transaction fees and miner revenue, reshaping the economic landscape of the network.

Altcoins on Bitcoin Mark a New Milestone

Lucas Outumuro, Head of Research at IntoTheBlock, recently highlighted the seismic impact of Runes, describing it as “absolutely insane.” He pointed to the surge in daily fees which reached a record $80 million. This is about four times higher than the previous all-time high set in December 2017.

Furthermore, the average Bitcoin transaction fee has skyrocketed to $128, a figure that starkly overshadows the $30 peak during the initial frenzy over Ordinals.

This surge in fees has been a boon for miners, who despite a 50% drop in inflationary rewards due to the halving, saw their earnings spike by 1,200% following the Runes launch. The sudden spike lead to a record $100 million in Bitcoin mining revenue.

Still, the introduction of Runes coincided with a significant downturn in new Bitcoin addresses, which have hit a two-year low. According to Outumuro, this indicates that the current surge is driven predominantly by seasoned crypto enthusiasts, with retail investors yet to join the fray.

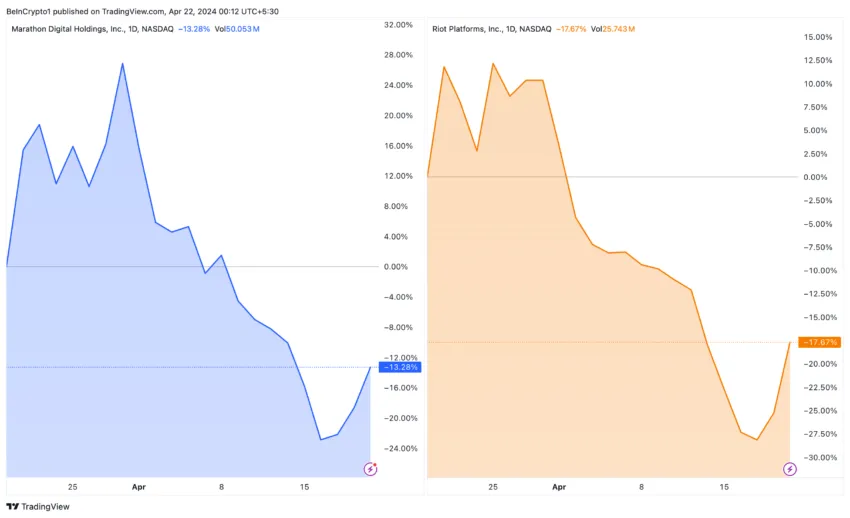

The traditional finance sector, particularly Wall Street, was caught off guard by these developments. Stocks like Marathon Digital Holdings (MARA) and Riot Platforms (RIOT) saw over a 20% decline in the month leading up to the halving, underestimating the potential of Runes and the adaptability of the crypto market.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks Ahead of 2024 Halving

This historic network transformation suggests a solution to Bitcoin’s long-standing security challenges, propelled by what many in the industry refer to as “shitcoins.” The interest for these assets generates increased network activity and more transactions for miners to process. Consequently, it becomes more profitable to mine Bitcoin.

As this trend continues, the real test will be its sustainability and whether the early momentum can be maintained.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment