Since December 8, the stablecoin economy has grown 3.59% in 17 days as numerous stablecoin market valuations have issued more fiat-pegged tokens this month. On Saturday, December 25, the stablecoin economy’s $167 billion market valuation represents 6.68% of the entire $2.49 trillion crypto market economy.

Stablecoin Issuance Jumps 3.5%

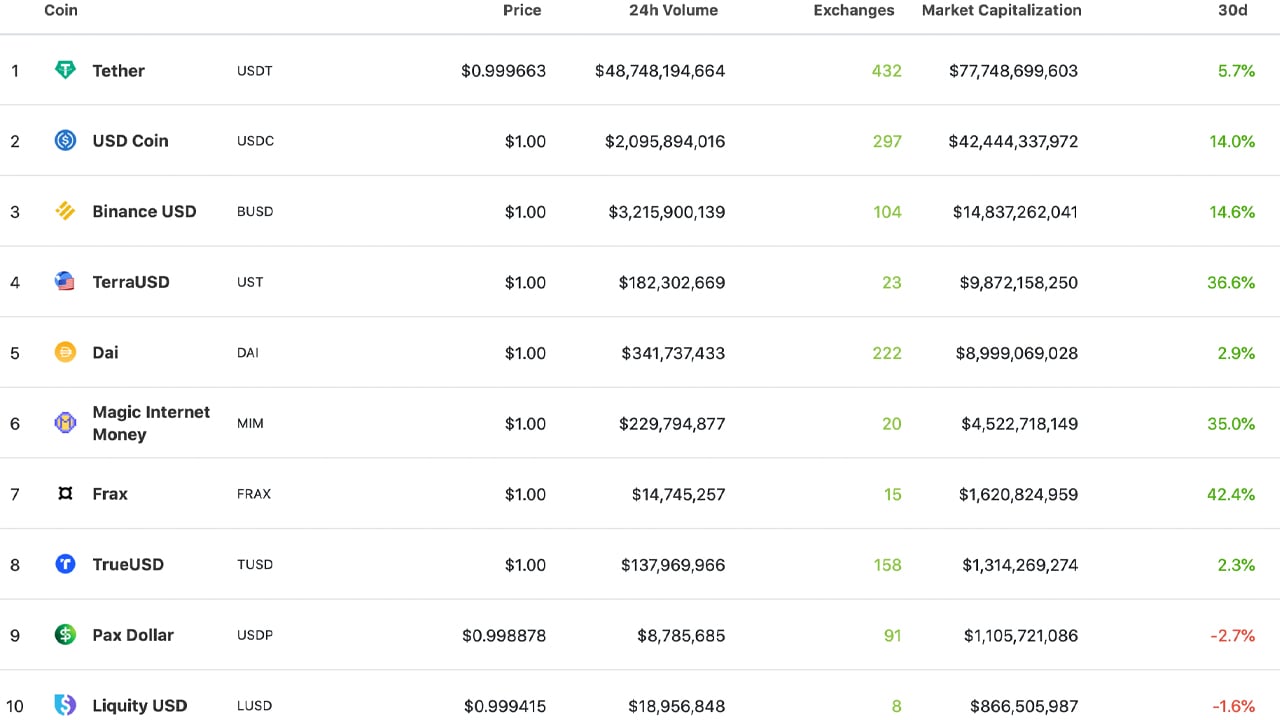

There’s a great number of stablecoins in existence today that are pegged to the value of fiat currencies like the U.S. dollar. The U.S. dollar is the most common stablecoin peg today, but there are others that represent the euro and the Swiss franc. On Saturday, the total value of all the stablecoins in existence is $167 billion, up 3.59% since our newsdesk’s last stablecoin report. The most dominant stablecoin today is tether (USDT) with a market valuation of around $77.7 billion spread across various blockchains.

Tether’s sizable market capitalization is 46.52% of the entire stablecoin economy today. Usd coin (USDC) is the second largest stablecoin in terms of market capitalization with $42.4 billion. While USDT increased 5.7% during the last month, USDC climbed 14% during the last 30 days. The third, fourth and fifth largest stablecoin market valuations belong to BUSD, UST, and DAI respectively. BUSD’s $14.8 billion market cap increased by 14.6% during the last month and UST’s issuance jumped by 36.6%.

60% of Today’s Trades Are Paired With Stablecoins

The Makerdao-issued stablecoin DAI increased by 2.9% this past month with a valuation of around $8.9 billion. Terra Protocol’s UST stablecoin is 9.18% larger with a valuation of around $9.8 billion at the time of writing. MIM, FRAX, and FEI saw notable issuance increases as well with anywhere between 15.6% to 42.4% during the last month. The stablecoin origin dollar (OUSD) spiked more than 102% over the last 30 days and SUSD jumped 38.7%.

On Saturday, the stablecoin economy commands $55.4 billion in trade volume out of the aggregate $92.1 billion reported volume. This means with every trade today, 60.15% of the trades are paired with stablecoins. For instance, the leading crypto asset in terms of market valuation, bitcoin (BTC), has seen around 59.68% of today’s swaps with tether (USDT). The second leading crypto asset, ethereum (ETH), has similar metrics as 51.45% of all ether swaps are with tether as well.

What do you think about the stablecoin market valuation during the last 17 days swelling around 3.59%? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coingecko.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Be the first to comment