Shiba Inu recently implemented a rigorous token burn campaign, leaving the SHIB army ecstatic but can it aid a price recovery from the lower support levels as hoped?

Despite their bearish undertones, meme tokens often carve their niche in the crypto market by pushing gains and charting rallies.

With ecosystem-centric developments taking place for Shiba Inu, SHIB, the second largest meme coin by market capitalization, is expected to make strides in the positive direction. The question, for now, remains whether the recent developments can push SHIB’s price giving it a much-needed bullish boost.

Burn SHIB until the price goes up?

SHIB HODLers have been dreaming of price gains since Aug. 15, when the meme token saw close to 45% gains in just four days. Last week, after Shiba Inu’s pseudonymous founder and lead developer, Shytoshi Kusama, made the announcement of an aggressive token burn campaign investor eyes once again gleamed with the hopes of an incoming rally.

Up until Sept. 22, more than 410 trillion SHIB have been burnt in total from the initial supply which accounts for over 41% of the maximum total supply to date.

In the last 24 hours, from the time of press, a total of 11.7 million SHIB tokens were burned across three transactions, as per data from Shib Burn.

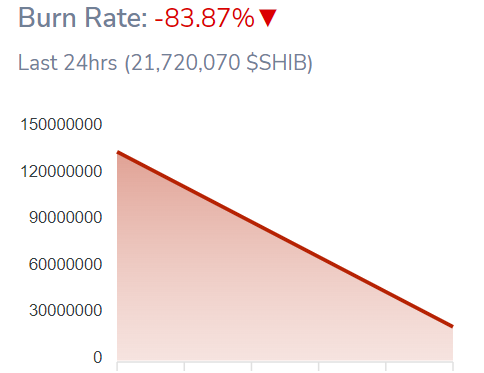

On Sept. 21, there was a notable uptick in the token’s burn rate as a high amount of SHIB tokens were sent to a dead wallet pushing the burn rate up by 1,500%. However, at press time, as campaign anticipation faded, the burn rate slumped by 83%.

Looking at the long-term trend, a considerable amount of SHIB has been burned which contributes to the network’s health by reducing the supply. Even though this supply burn is expected to have a long-term bullish effect, will the same apply to token demand?

SHIB supply falling but what about demand?

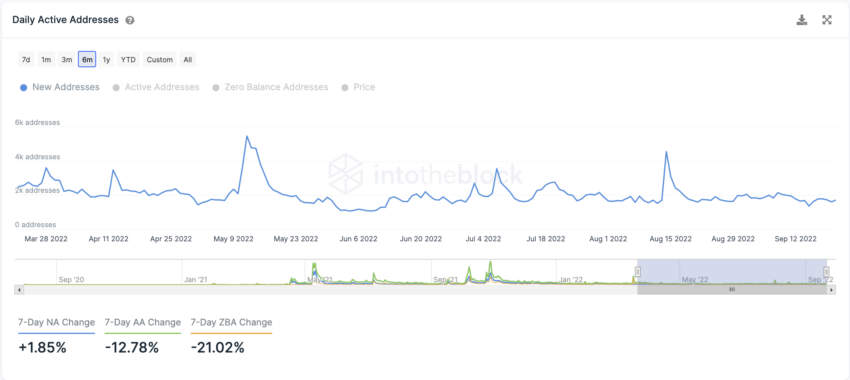

With SHIB’s supply reducing the same should ideally have a bullish effect on the token if demand grows. Network indicators presented a steady rise in new daily addresses with a 1.85% increase over the last week. On average around 1,600 addresses are being created per day in September.

Apart from certain anomalies in August when over 4,000 new addresses were created, retail interest in SHIB has seen no major spikes.

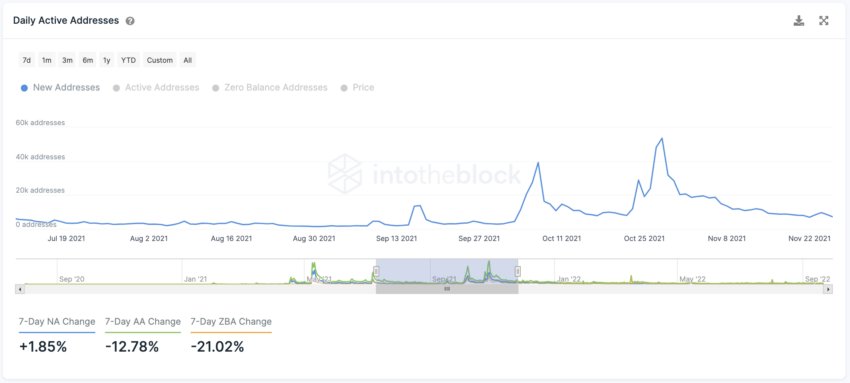

Retail euphoria aids price growth as new entities make an entry into the market. Notably for SHIB, its price rallied in October 2021 and then in February 2022, a spike in new addresses created saw SHIB’s price rise in tandem.

All pain and no gain?

At press time, SHIB’s price oscillated close to the $0.00001078 mark charting 3.04% gains on the day. Despite the long-term bullish anticipation, the short-term price action seems more or less dependent on the market.

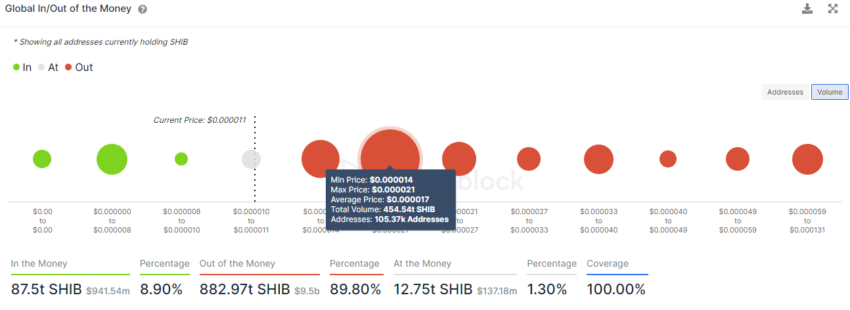

Additionally, SHIB’s supply-demand dynamics present some crucial price barriers for the token in the short term before the price can finally pick up momentum.

The Global In and Out of Money indicator presented the next most significant supply barrier for SHIB rested at the $0.000017 level where 105,000 addresses hold over 450 trillion tokens. If bulls manage to push prices above the aforementioned supply barrier at $0.000017 there could be more room for gains.

For now, the long-term support at $0.00001050 aided SHIB’s price from falling further.

Data from IntoTheBlock further shows that over 75% of HODLers were ‘out of the money’ or at a loss at the time of press. On the whole, the improving supply-demand dynamics could aid SHIB’s growth if demand for the token spikes.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment