Riot Platforms (NASDAQ: RIOT) stock price continued its sell-off even as Bitcoin and other cryptocurrencies held steady. The shares plunged to a low of $8.90 on Tuesday, the lowest level since April 6th. It has retreated by more than 56% from its highest point this year, meaning it is in a deep bear zone.

Bitcoin is holding really well

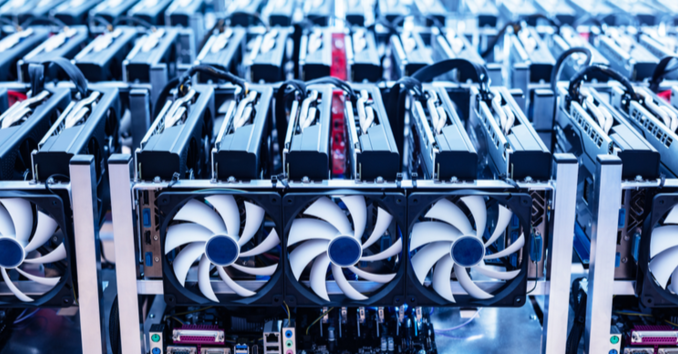

Riot Platforms is a major company in the Bitcoin mining industry. The company runs some of the biggest mining rigs in the world. For example, its Rockdale facility is the biggest mining and hosting facility in North America. It has a deployed hash rate of 10.7 EH/s.

Riot Platforms and other mining companies like Marathon Digital, Cipher Mining, and Argo Blockchain tend to do well when Bitcoin price is rising. This explains why the shares jumped to a high of over $20.6 when Bitcoin surged to the year-to-date high of $32,000.

Therefore, it is quite surprising that the Riot Platforms share price has plunged even as Bitcoin has done well in the past few weeks. Bitcoin has remained above $26,200 even as the fear and greed index has dropped to the extreme fear zone of 25. The Dow Jones, Nasdaq 100, and S&P 500 have also slipped sharply recently.

I believe that Riot Platforms and Marathon Digital are good speculative buys. For one, I believe that Bitcoin will be much higher than where it is today. Bitcoin halving is coming in 2024, which will likely push its price higher.

Further, I suspect that the Securities and Exchange Commission (SEC) will approve a spot Bitcoin ETF. Besides, the leading applicants are some of the biggest companies in the industry like Blackrock, Fidelity, and WisdomTree.

Most importantly, Bitcoin has held quite well even as the Federal Reserve has hiked interest rates to the highest point in more than two decades.

Riot Platforms stock price forecast

The daily chart shows that the RIOT share price has been in a strong bearish trend in the past few months. It recently crashed below the key support at $14.45, the highest point in April this year. The stock has dropped below the key support at $10.07, the lowest point on August 25th.

Most importantly, the 50-day and 200-day weighted moving averages (WMA) are about to form a death cross. Therefore, the stock will likely remain underwater for a while. If this happens, the next level to watch will be at $8.

Be the first to comment