Bitcoin price prediction is neutral, as it remains in a narrow trading range of $16,850 to $17,250. Investors are waiting for a solid fundamental reason to trigger a breakout, but once it breaks out of this range, there will likely be an incredible trade opportunity.

So it’s important to keep an eye on the fundamentals that can influence BTC price action.

On the day, the total market capitalization of all cryptocurrencies increased by 0.92% to $859.91 billion, with major cryptocurrencies trading primarily in green. Several well-known and well-known cryptocurrencies rose unexpectedly this morning, even as the market continues to deal with the aftermath of the FTX.

The reason for the bullish rally, however, could be attributed to Fed Chair Jerome Powell’s dovish comments, which suggest the central bank will slow the pace of its interest rate hikes.

On the other hand, it was thought that the weaker US dollar, which recently hit a three-month low, was a significant factor in keeping Bitcoin prices high, because BTC has a strong negative correlation with the US Dollar Index.

Cryptocurrency Market Rebound

The FTX company’s collapse has caused the entire cryptocurrency market to struggle in recent days. Since FTX, one of the world’s largest cryptocurrency exchanges, filed for bankruptcy and it was revealed that Sam Bankman-Fried, the former CEO, may have been involved in severely fraudulent activities, the cryptocurrency market has been dwindling.

Furthermore, BlockFi and other significant cryptocurrency businesses recently declared bankruptcy, further depressing the cryptocurrency market.

Despite this, it was able to reverse its downward trend and make a small recovery on the day. This occurred when the valuations of the two most valuable cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), surpassed $17,000 and $1,200, respectively.

Meanwhile, Dogecoin (DOGE), Solana (SOL), Ripple (XRP), and Litecoin (LTC) are all on the rise. Notably, the Aptos (APT) token was the top gainer, gaining more than 9.5% in 24 hours.

However, the cryptocurrency market began to recover after Federal Reserve Chair Jerome Powell announced that the central bank’s interest rate hike would be halted.

The markets are pricing in an 80% chance that the Fed will raise interest rates by 50 basis points at its upcoming meeting, versus a 20% chance that rates will rise by another 75 basis points.

US Dollar Fell Multi-Month Low

Another important factor supporting BTC prices was the weakening of the US dollar, which hit a three-month low. Investors took advantage of unexpectedly positive job data, which was viewed as one of the key factors in limiting the dollar’s declines.

However, the value of the dollar rose slightly as reports revealed that businesses added 263,000 jobs in November, far exceeding the 200,000 forecasts. However, the declines were short-lived, as they fell to a three-month low amid a dovish stance.

CFTC Chair Rostin Behnam Claim Bitcoin Is a Commodity

The Commodity Futures Trading Commission (CFTC) chair, Rostin Behnam, stated that only Bitcoin should be classified as a commodity. Behnam shared his thoughts on a secret cryptocurrency gathering held at Princeton University.

Contrary to what Behnam previously believed, Ethereum is not a commodity. As a result, this news has had no effect on BTC prices as of yet.

Bitcoin Price

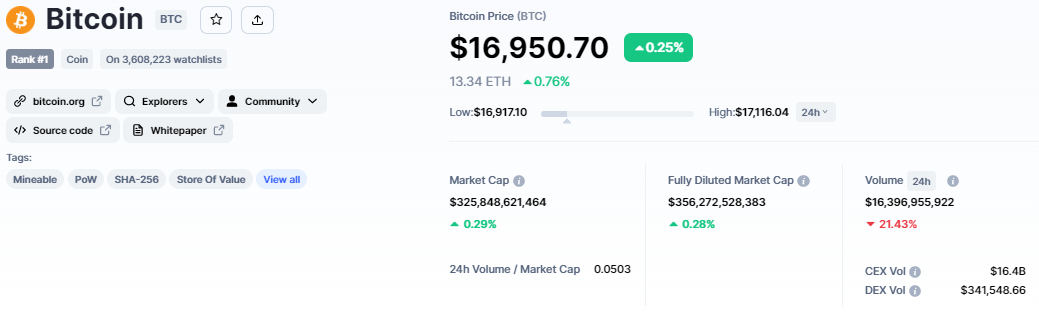

The current Bitcoin price is $$16,991, with a 24-hour trading volume of $16 billion. The BTC/USD pair has surged nearly 0.50% in the last 24 hours. Additionally, its value has increased by around 3% in the past week.

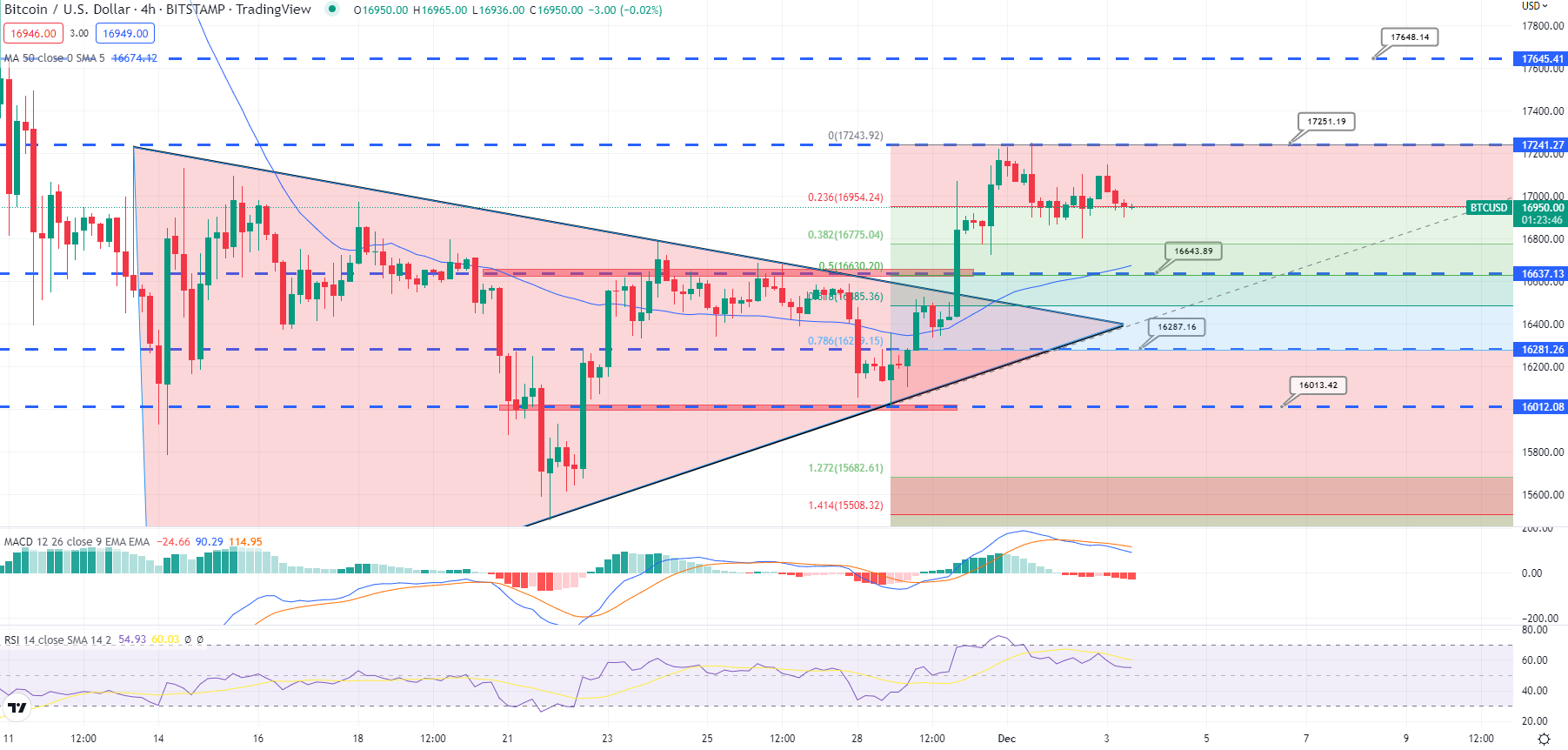

The BTC/USD pair has been unable to break through the $17,250 level, and the appearance of doji candles suggests that a bearish correction is possible.

If the price falls below $16,950, further selling may occur until the $16,750 level is reached. This move would be a 23.6% Fibonacci retracement of the most recent high.

If Bitcoin continues to fall, it may target the $16,600 level, which represents a 50% Fibonacci extension, and a break below this level may expose the cryptocurrency to a move down to the $16,450 level, which represents a 61.8% Fibonacci extension.

A bullish breakout above $17,250, on the other hand, could lead to a move up to $17,650 and $18,100.

Coins with Huge Upside Potential

Despite the market downturn, these coins have performed exceptionally well, attracting the attention of crypto whales. One of these is IMPT, whose presale is ending just in 1 week.

IMPT (IMPT): 1 Week to Buy This $13.5 Million Green Crypto

Another Ethereum-based platform, IMPT is a carbon-credit marketplace that will reward consumers for shopping with eco-friendly merchants. These rewards will arrive in the form of its IMPT token, which can be used to buy NFT-based carbon offsets that can be traded or retired.

Since opening its sale in October, IMPT has raised more than $13.6 million, with 1 IMPT currently being sold at a price of $0.023. IMPT.io, a revolutionary platform for carbon offsetting and carbon credits trading, will prematurely end its token presale on December 11th, due to its overwhelming success.

Visit IMPT Now

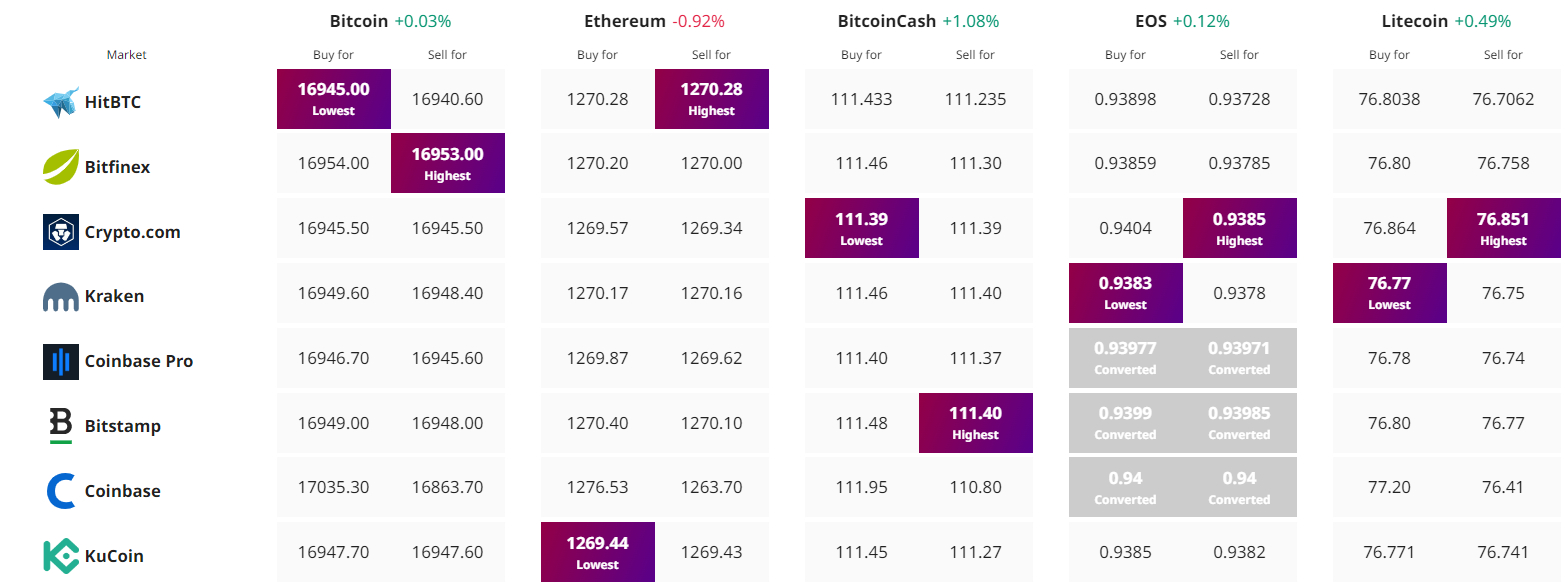

Find The Best Price to Buy/Sell Cryptocurrency

Be the first to comment