One of the most covered criticisms of Ethereum since its creation in 2015 has been its mammoth energy usage.

While not as heavy as Bitcoin, it nonetheless consumes 0.2% of the world’s electricity, and is responsible for between 20% and 39% of cryptocurrency’s electricity consumption as a whole (Bitcoin claims between 60% and 70%).

Now – and going forward – that energy consumption has fallen 99.95% following the successful completion of the Merge. It’s an incredible achievement.

What is the Ethereum PoW token?

Miners will thus have to find another coin to mine. However, some are clinging to hope that a fork of Ethereum will maintain the Proof-of-Work validation consensus which will allow them to continue to mine.

The PoW token will be received via airdrop to holders of Ethereum, with its price varying over the last few days quite drastically. Peaking as high as $60, it currently trades at $18.

How does Ethereum mining work?

Ethereum miners have to date used powerful computers known as ASICs to validate transactions. With staking, this is no longer necessary, meaning their livelihoods are in question. Many have swapped to other cryptos in order to continue to mine, and the effect of this can be seen in the hash rate of these other cryptos.

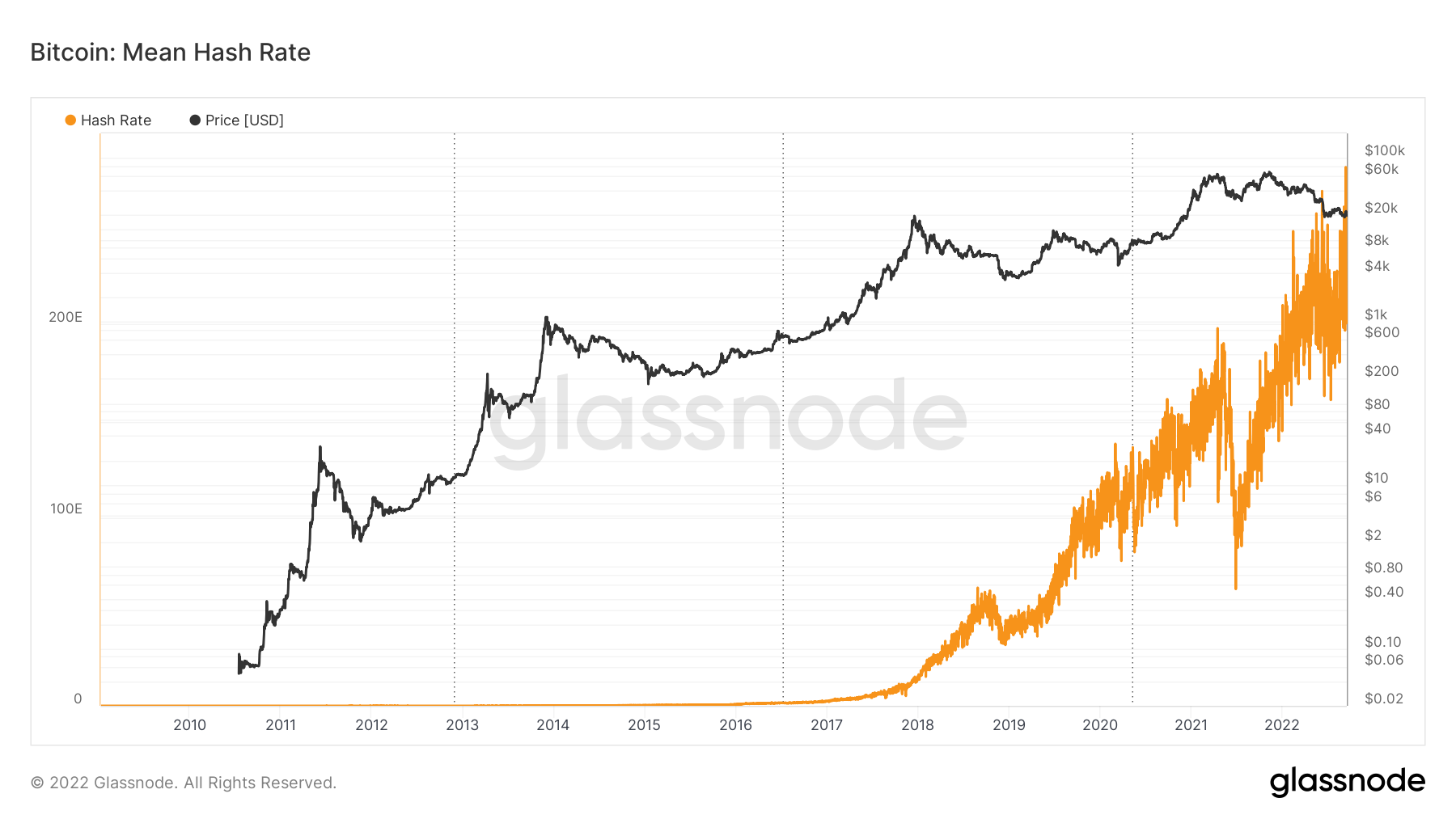

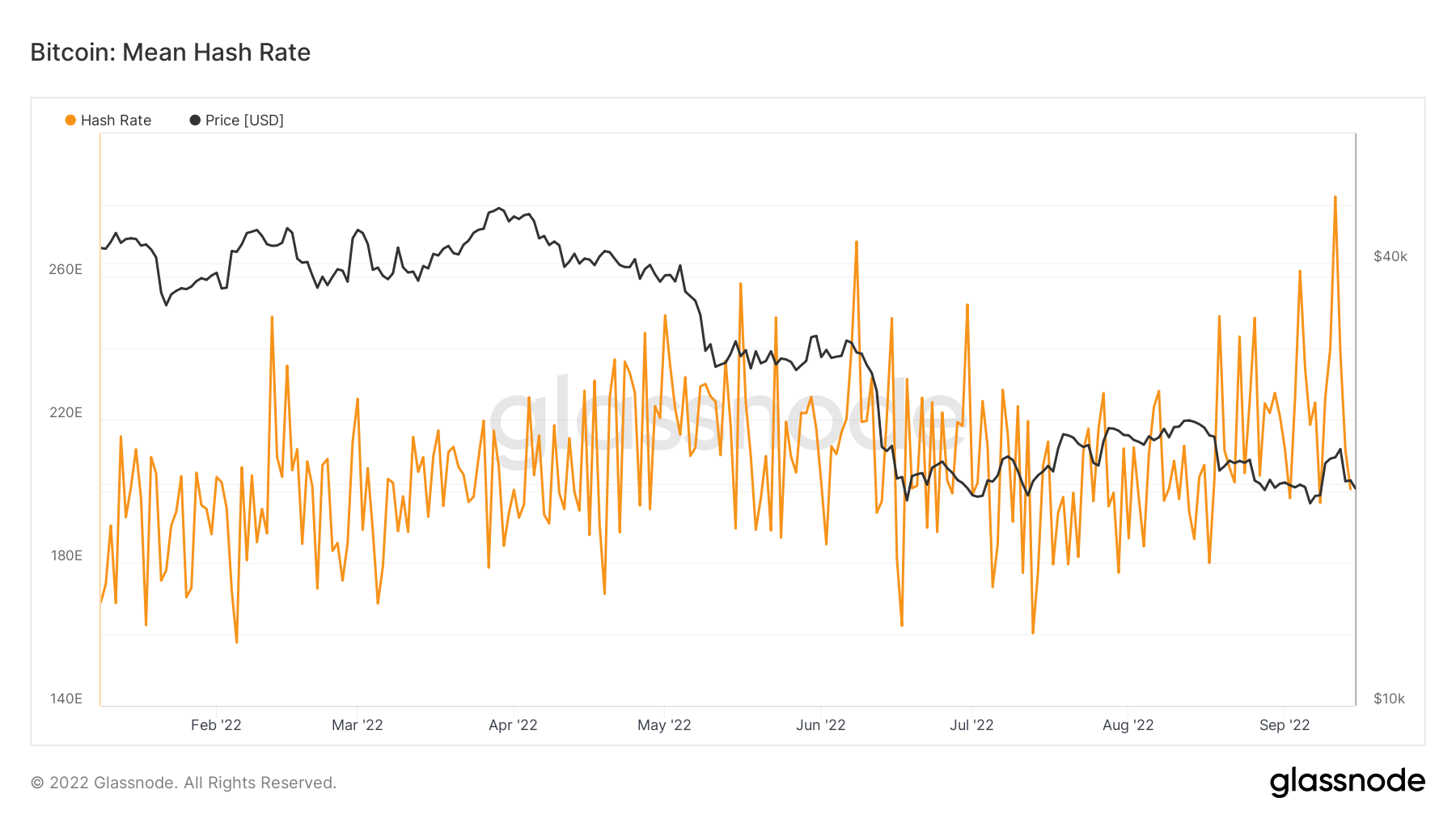

Hash rate is a measure of the computing power on a network, and is a key security indicator – the higher the hash rate, the higher the security, as more miners have to verify transactions. For Bitcoin, the hash rate hit an all-time high last week.

Let’s zoom in on this year, which may be more indicative.

This shows the hash rate opened the year at around 170 EH/s, yet is now north of 200 EH/s (and hit 280 EH/s earlier this week). This is despite the price of Bitcoin plummeting from the mid $40K’s to below $20,000.

Ethereum Classic

More interestingly, however, is the uptick in hash rate seen on Ethereum Classic. This has been drastic, rising from around 50 TH/s last week to over 300 TH/s. This points towards Ethereum miners flipping over to the Classic variant with their equipment – a much easier shift than would be required to move to Bitcoin.

Indeed, other coins have seen upticks in hash rate as well – Monero, Ravencoin, Ergo, to name a few.

Indeed, other coins have seen upticks in hash rate as well – Monero, Ravencoin, Ergo, to name a few.

For the miners that have not flipped to alternatives, they will hold out hope that the Ethereum PoW alternative takes hold. Otherwise, they’ll be left with expensive ASICs and no real use case, now that Ethereum is Proof-of-Stake and no longer generating miner revenue.

Be the first to comment