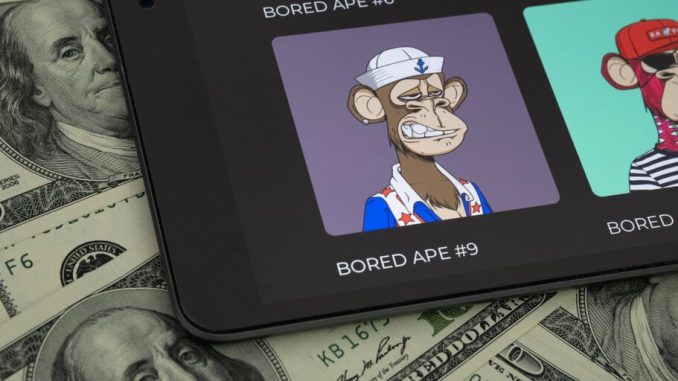

With Bored Ape Yacht Club prices hitting a two-year low and other prominent projects seeing sizable price drops of late, many investors and influencers in the NFT world are starting to point fingers at who’s to blame—and many of those fingers are pointing at Blur.

Amid falling NFT prices, traders are more vocally pushing back against the incentivized trading model of the upstart marketplace, which overtook OpenSea as the leading Ethereum NFT trading platform by volume in February. Blur has reinforced the notion that NFTs—which can represent assets like artwork and in-game items—aren’t unique, but rather are merely “altcoins with pictures” as crypto influencer Cobie controversially tweeted last year.

Launched last October as an upstart marketplace, Blur branded itself as the platform for pro NFT traders and teased a token airdrop that would make it worthwhile to use the platform over OpenSea and other rivals. When the BLUR token finally came in February, Blur immediately leapfrogged OpenSea to become the top marketplace by trading volume.

But that incentive model was immediately controversial in some corners of the NFT world. Traders began rapidly flipping NFTs to yield rewards, treating Bored Apes and Otherside land plots like fungible tokens. Trading volume on Blur surged, pushing February’s market-wide tally above $2 billion—but some, including data platform CryptoSlam, have called the flipping “wash trading.”

The Blur boost was short-lived. Overall market trading has fallen sharply in recent months, and whale traders who expertly gamed the rewards model at first are now losing money and/or pulling their funds out of Blur’s NFT bidding pool.

Over the last couple days, Crypto Twitter influencers have increasingly pointed to what they see as negative effects from Blur’s approach. Trevor Owens, general partner at the Bitcoin Frontier Fund, wrote Tuesday that marketplaces battle over controlling the price “floor,” or the cheapest-listed NFT from a project, and that Blur’s tactics have harmed the market.

“Blur is spending tens of millions of $$ in airdrop incentives to [lower the floor]. Spending tens of millions to tank the NFT market to control the floor,” he tweeted. “This is directly eating into your bags. Every $$ they spend lowers the NFT market proportionally.”

Owens’ tweet echoed that of a tweet from NFT influencer Xero, who pointed to a recent cascade of NFT loan liquidations—most of them through Blur’s own Blend lending platform—and said that Blur incentivized risky behavior as traders over-leveraged themselves to flip NFTs.

“Accounts that had no business buying dozens or more of a collection put themselves into dangerous positions,” Xero wrote. “The incentivization for dumping and bidding low comes from obtaining Blur tokens, so they are just doing what the marketplace is telling them to.”

And in a lengthy blog post, a crypto and NFT trader who calls himself Mihai picked apart what he sees as problems with the Blur model and its impact on the broader NFT market, reaching the conclusion that Blur is “nuking your NFT prices,” as he tweeted Tuesday.

“Blur presently creates a dichotomy between ‘mercenary’ and ‘genuine’ market participants, destabilizes NFT prices, and engenders a cyclic dumping problem, potentially undermining the platform’s long-term sustainability and the overall health of the NFT market,” Mihai wrote.

The founder of Blur, unsurprisingly, does not agree with their assessments.

Tieshun “Pacman” Roquerre, the founder of Blur, tweeted Wednesday afternoon that “some floor prices have gone up [and] some floor prices have gone down” since the marketplace launched last October. He also pointed to last week’s controversial launch of the Azuki Elementals collection for pulling liquidity out of the NFT market.

“One of the few times floor prices went up in concert was when we injected liquidity into NFTs via our airdrop,” he wrote. “One of the few times floor prices went down in concert was when $40m of liquidity was removed via the Azuki mint (not throwing stones, the market just moves based on liquidity more than anything else).”

In the tweet, which quote-tweeted someone defending Blur amid the growing chorus of complaints, Pacman said that such criticism is the “cost of doing business.”

“When asset prices are up, [people] don’t really talk about the root cause (i.e. Blur injecting liquidity), but when they are down, the pitchforks come out,” Pacman added. “Bad takes spread like wildfire.”

Pacman’s tweet makes no suggestion that Blur will change its model in response to the growing criticism. Today’s launch of Blur’s v2 protocol adds a new type of NFT bidding and associated rewards, along with cheaper transaction fees. An official tweet thread about the launch only reinforces the emphasis on boosting trading rewards.

One Bored Ape owner retorted by calling Pacman “fucking delusional” and accused the founder of gaslighting traders. “Your platform literally tears down projects bit by bit by removing confidence in the market,” the pseudonymous GeeGazza added.

At least one prominent builder supports Pacman’s take, however. Rohun “Frank” Vora, founder of DeGods, replied saying that the “brutal reality” is that traders are “simply voting with their dollars,” because they believe that the “BLUR airdrop will be more valuable than holding the NFTs.”

“If a free market cannot withstand independent actors creating their own incentive models on top of the market,” Frank added, “then it’s a weak market in the first place.”

Stay on top of crypto news, get daily updates in your inbox.

Be the first to comment