Key Takeaways

Ethereum looks weak around the current price levels as trading volumes decreases.

Although Ethereum is expected to complete “the Merge” to Proof-of-Stake this year, market sentiment is at a low.

A spike in downward pressure could see ETH fall as far as $900.

Share this article

Ethereum looks poised for significant losses after failing to overcome a critical hurdle in its trend. Despite the market’s anticipation for “the Merge,” selling pressure could resume if it breaks the $1,700 support level.

Ethereum Resumes Downtrend

Ethereum is weakening while trading volumes are falling in the cryptocurrency market.

The second-largest cryptocurrency by market cap looks primed to resume its downtrend after suffering a rejection at the $2,150 resistance level. Although Ethereum successfully held $1,700 as support, it has not shown enough strength to make a significant advancement. The current market conditions could encourage investors to exit their positions in expectation of lower lows.

Ethereum is expected to complete its long-awaited “Merge” to Proof-of-Stake this year, which could act as a bullish catalyst, but the launch date is likely months away. Ethereum recently completed its Merge testnets and will next give the update a trial run on the Ropsten testnet. With no final launch date in sight and sentiment in the crypto market still at a low, Ethereum could face a major correction in the short term.

When considering that the governing technical pattern behind Ethereum is a symmetrical triangle, the recent rejection could be followed by a spike in selling pressure. This technical formation forecasts that after the $2,500 support level was breached on May 9, Ethereum entered a 64% downtrend.

A daily candlestick close below $1,700 could further validate the pessimistic outlook and result in a steep correction to $900.

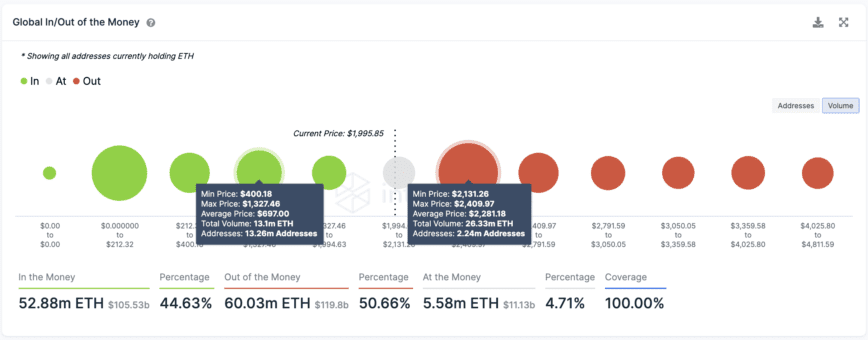

IntoTheBlock’s Global In/Out of the Money model adds credence to the bearish thesis. It shows that more than 2.24 million addresses are “underwater” on their holdings after purchasing over 26.33 million Ethereum between $2,130 and $2,400. These addresses could sell their assets in the event of another downswing to avoid incurring further losses, adding to the downward pressure.

In this eventuality, transaction history reveals that the most critical support level lies between $400 and $1,330, where 13.26 million addresses hold more than 13.1 million Ethereum.

Given the significance of the supply wall between $2,130 and $2,400, Ethereum will likely have to claim this area as support for a chance of invalidating the pessimistic outlook.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Be the first to comment