One of the largest publicly listed bitcoin miners, Core Scientific, has shaken investors with a recent filing with the U.S. Securities and Exchange Commission that raises the possibility the company may apply for bankruptcy protection. The filing notes that Core Scientific will be unable to pay down debt payments due for Oct. and early Nov. 2022.

SEC Filing Shakes Core Scientific Investors, CORZ Slides 97% in 12 Months

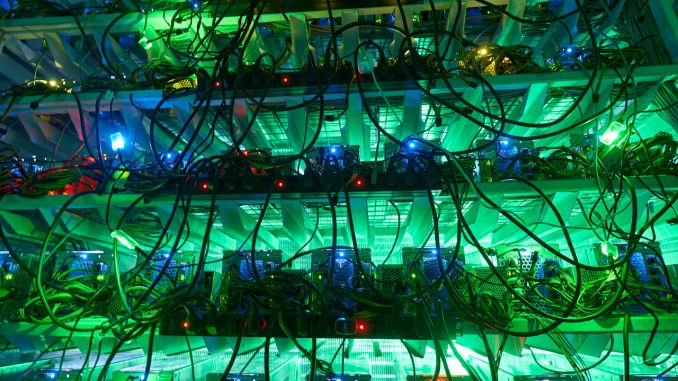

Bitcoin miners are having issues after the price of bitcoin (BTC) has slid roughly 70% against the U.S. dollar since Nov. 10, 2021. Moreover, the network’s mining difficulty is currently at an all-time high, making it harder than ever before to find a block subsidy. At the end of September, Bitcoin.com News reported on Compute North filing for bankruptcy and how it led to Marathon Digital’s shares getting downgraded. Now Core Scientific (Nasdaq: CORZ) seems to be leaning in the direction of filing for bankruptcy protection or some sort of restructuring process.

The news stems from a U.S. Securities and Exchange Commission (SEC) filing Core Scientific filed on Oct. 26, 2022. Essentially, Core Scientific says it will not be able to make loan payments for Oct. and early November, and the team has been engaged with law firms in order to discuss a possible restructuring process or filing for bankruptcy protection. The company cites that its finances have been depleted and it blames the price of bitcoin (BTC) and other types of negative exposure.

“As previously disclosed, the Company’s operating performance and liquidity have been severely impacted by the prolonged decrease in the price of bitcoin, the increase in electricity costs, the increase in the global bitcoin network hash rate and the litigation with Celsius Networks LLC and its affiliates,” Core Scientific’s filing notes. As of Oct. 26, Core Scientific has roughly 24 BTC in reserves which equates to $497,901, using today’s BTC exchange rates.

Since the SEC filing, Core Scientific’s stock CORZ is down 97% year-to-date. Furthermore, on Oct. 28, the B. Riley analyst Lucas Pipes downgraded CORZ to neutral. “While Core has prioritized liquidity since the start of the crypto winter, we believe negative hosting margins (during 2Q) and compressed self-mining margins have exerted extra pressure on the company’s ability to meet its financial obligations,” the analyst noted on Friday.

What do you think about Core Scientific’s SEC filing? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Be the first to comment