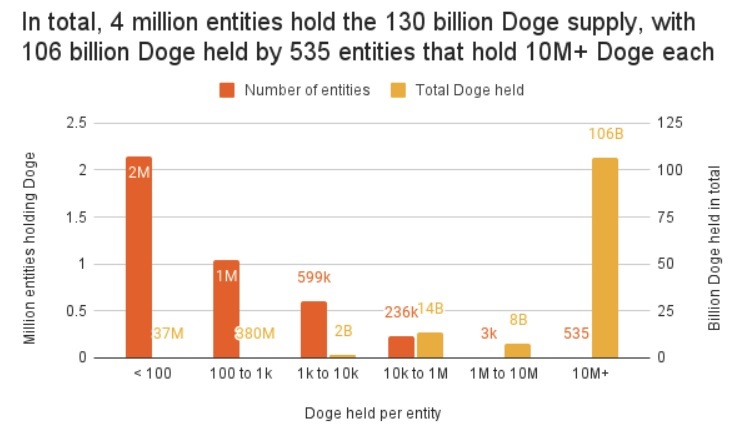

Blockchain analytics firm Chainalysis says dogecoin “is currently being adopted by new investors at a level not seen since the late-2017 bull market.” The firm further noted that “most of the supply is held by a small number of wealthy entities.” Specifically, 82% of the DOGE supply is held by 535 entities that hold more than 10 million DOGE each.

Chainalysis’ Analysis of Dogecoin

Blockchain data platform Chainalysis published a Market Intel report on dogecoin last week. The firm’s chief economist, Philip Gradwell, explained:

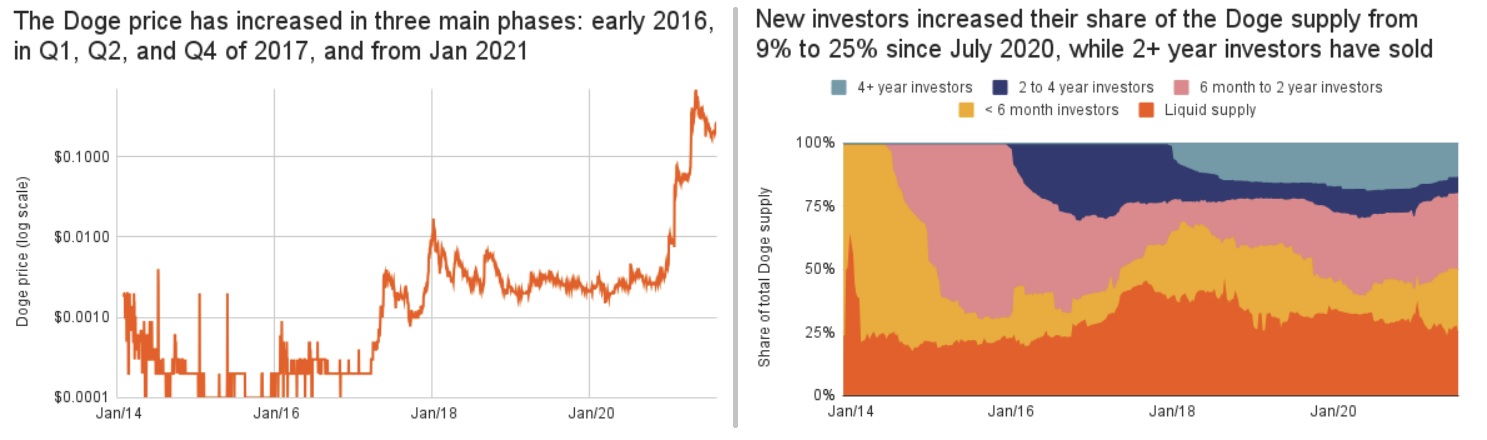

Exclusive on-chain analysis of dogecoin shows it is currently being adopted by new investors at a level not seen since the late-2017 bull market, with new investors increasing their share of supply from 9% in July 2020 to 25% in August 2021.

Chainalysis’ chief economist also pointed out that dogecoin ownership is very concentrated citing that “a small number of wealthy entities own most of the supply.”

He explained that there are currently 4 million on-chain DOGE holders. However, “106 billion DOGE, 82% of supply, is held by 535 entities that hold more than 10 million DOGE each, or 0.01% of entities,” he said, adding that “This is likely a mixture of businesses, such as exchanges that store DOGE on behalf of millions of traders, and a few, now-wealthy, early investors.”

He further noted that out of 4 million DOGE holders, 2.1 million entities hold less than 100 DOGE each, with half them holding the meme cryptocurrency for more than two years. The economist explained that “These low-balance entities are not necessarily individuals, but are likely to be scattered wallets, belonging to a smaller number of individuals.”

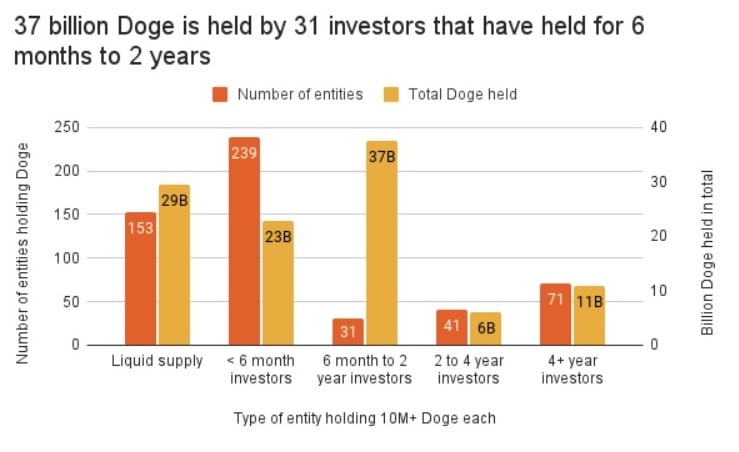

The analysis further reveals: “37 billion of the 106 billion DOGE is held by just 31 investors that have held their DOGE for between 6 months and 2 years – that is over 1 billion DOGE each on average. Some of these may be businesses, such as exchanges.”

Noting that “DOGE is an asset like any other, with changes in ownership and liquidity in response to changes in demand and price,” the economist detailed:

Dogecoin’s price rise demonstrates that cryptocurrencies are experiments in branding for financial assets, plugged directly into the craziness and creativity of the internet. While this may seem counter to traditional financial brand values, it may be that traditional financial brand values are out of step with consumers.

What do you think about Chainalysis’ analysis of dogecoin? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Be the first to comment