Key Takeaways

Bitcoin’s uptrend seems to be reaching a point of exhaustion.

Whales have been selling in preparation for a pullback.

The $45,230-$46,560 resistance level will decide where BTC goes next.

Share this article

On-chain metrics have registered a spike in profit-taking behind Bitcoin following an impressive bull rally. If sell orders continue to pile up, BTC could be poised to retrace.

Bitcoin Whales Book Profits

Bitcoin could be due for a big correction.

The leading crypto asset has posted significant gains over the past three weeks, gaining 17,000 points in market value. Bitcoin saw its price rise by 57% from a low of $29,800 on Jul. 21 to recently hitting a high of $46,800. Now, investors appear to have started booking profits.

Behavior analytics platform Santiment reveals that addresses with 100 to 10,000 BTC have significantly reduced their holdings. In the last four days alone, these whales sold over 40,000 BTC, worth roughly $2.07 billion.

The sudden spike in profit-taking comes at a time when Bitcoin has struggled to slice through a significant resistance barrier.

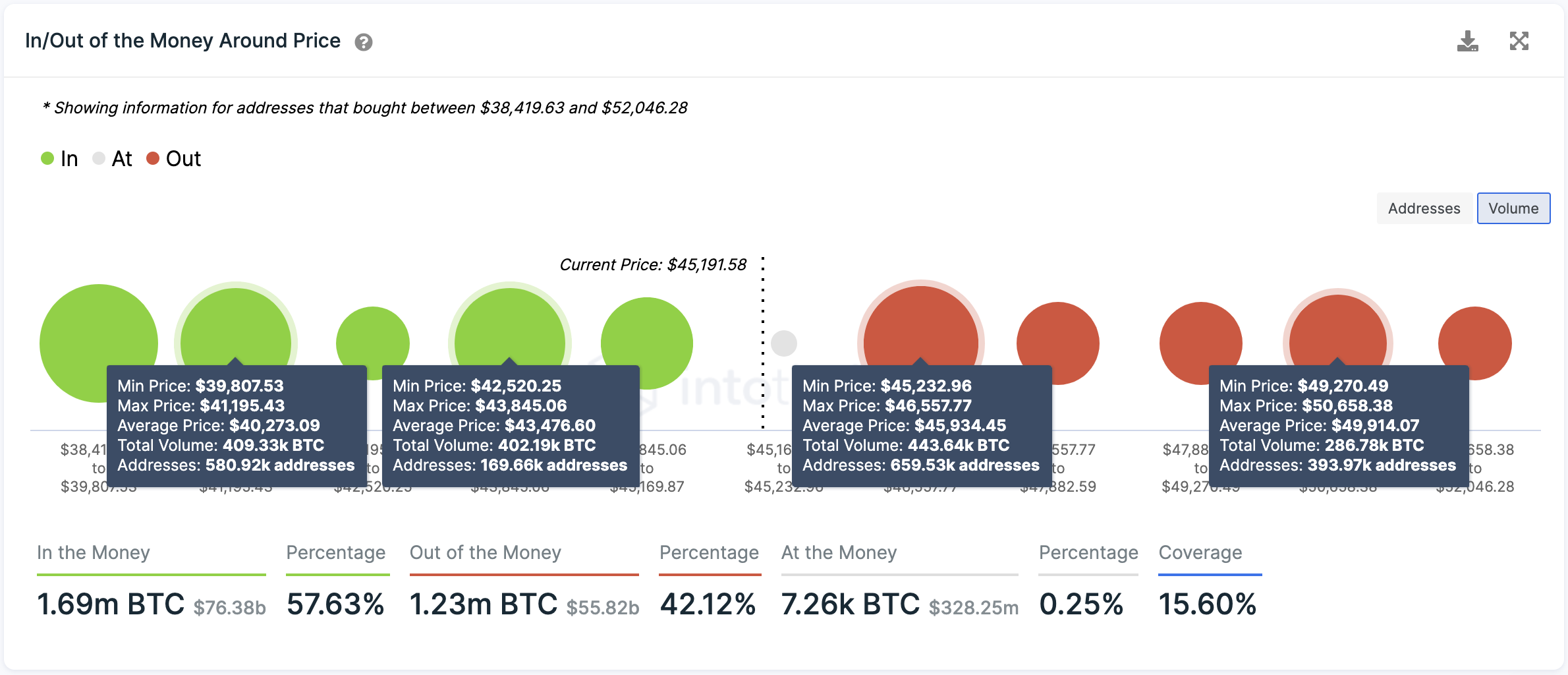

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that the supply zone between $45,230 and $46,560 has prevented Bitcoin from advancing further. Around this price level, nearly 660,000 addresses have previously purchased over 440,000 BTC.

Holders within the $45,230-$46,560 range who have been underwater may be trying to break even on their positions, slowing down the uptrend. If this selling pressure continues, Bitcoin could turn around.

The IOMAP reveals that the first-ranked cryptocurrency could find support between $42,500 and $43,850 in the event of a correction. This support level could keep falling prices at bay as 170,000 addresses bought more than 400,000 BTC here. But a break of this demand wall could lead to a downswing toward $40,300.

Investors who remain bullish despite the sell signals popping up should pay close attention to the $45,230-$46,560 resistance level. A decisive move above this supply zone could see Bitcoin rise toward the next interest area between $49,300 and $50,700.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Bitcoin at Make-or-Break Amid JPMorgan Fund Reports

Institutional interest in Bitcoin is on the rise, with JPMorgan reportedly looking to launch an in-house Bitcoin fund for wealthy clients. Meanwhile, the charts show that BTC is at a…

What is Impermanent Loss and How can you avoid it?

DeFi has given traders and investors new opportunities to earn on their crypto holdings. One of these ways is by providing liquidity to the Automated Market Makers (AMMs). Instead of holding assets,…

Grayscale Advances Bitcoin ETF Plans With New Hire

Grayscale Investments has hired a new global head of exchange-traded funds to lead the conversion of the company’s GBTC trust into a Bitcoin ETF. Grayscale Hires Global Head of ETFs…

Bitcoin Targets $50,000 But Profit-Taking Looks Imminent

Bitcoin has stolen the crypto spotlight as its price surged by more than 5.5% following Monday’s open. The sudden bullish impulse took many investors by surprise given gold’s significant losses…

Be the first to comment