While companies like Microbt, Bitmain, Innosilicon, Strongu, Ebang, and Canaan have ruled the roost in terms of manufacturing application-specific integrated circuit (ASIC) bitcoin miners, a new challenger has entered the competition. A relatively unknown integrated technology firm called AGM Group Holdings has seen a lot of ASIC sales and partnerships in recent times.

A Relatively Unknown Semiconductor Firm Has Been Revealing Large Bitcoin Mining Rig Purchase Orders

2021 has seen record sales, in terms of ASIC mining rigs sold by bitcoin mining rig manufacturers like Microbt, Bitmain, and Canaan. Mining operations located all around the world have purchased thousands of bitcoin mining devices from these firms during the last year.

The demand for ASICs has been so high, many orders placed this year are due to be shipped at some point in 2022. Now a new challenger has entered the ASIC bitcoin mining rig manufacturing competition and recent press announcements detail AGM Group Holdings (Nasdaq:AGMH) is selling a lot of crypto mining products.

On November 3, AGM announced it had “won a purchase order” from Code Chain New Continent Limited (Code Chain) and will deliver 10,000 units of its 100 terahash (TH/s) mining rigs. While AGM won the purchase order worth $65 million in ASIC machines, the mining products are expected to be shipped in the second half of 2022. According to AGM’s website, the company sells three types of bitcoin miners with various performance ratings.

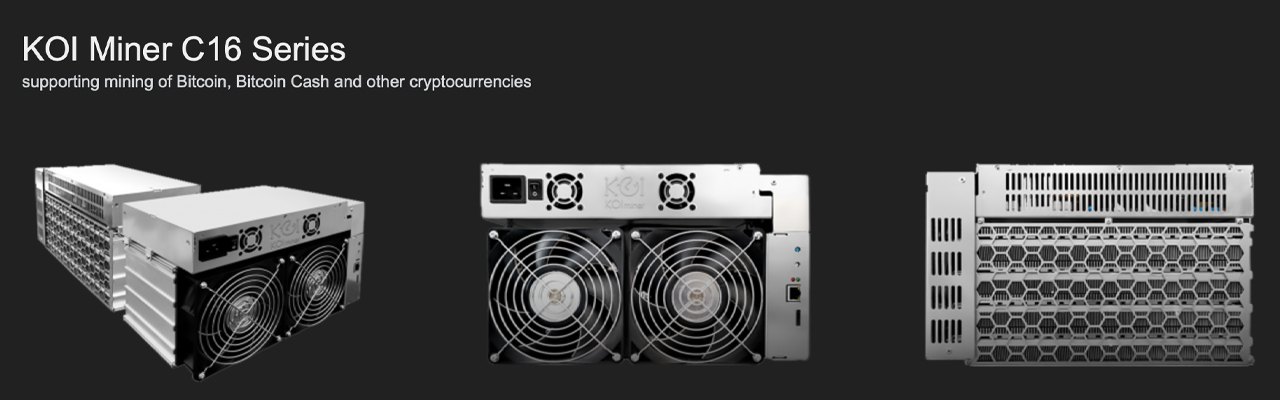

“[The] KOI Miner C16 Series [supports] mining of bitcoin, bitcoin cash and other cryptocurrencies. [The] KOI Miner C16 is built on a new architecture using FinFET N+1 process technology,” AGM’s website description details. “The computing power as a whole machine passes 100TH/s, as high as 113TH/s, with [the] energy consumption rate of the unit computing force reduced to as low as 30J/T.”

AGM’s Shares on Nasdaq Spike in Value

At 113 TH/s, the KOI Miner C16 S model is estimated to pull in $39.92 per day with an electrical consumption of $0.12 per kilowatt-hour (kWh). It would compete with the top three mining devices the Microbt Whatsminer M30S++, the Ipollo B2, and Bitmain’s Antminer S19 Pro. There are no reviews online yet about AGM’s KOI Miner C16 series miners and the machines are not yet listed on real-time ASIC hardware profitability rankings.

In addition to the November 3 purchase announcement, a slew of other media statements have been published by AGM during the last two months. AGM announced its “first significant order” for 30,000 mining rigs on October 13, when it sold the ASIC miners to Nowlit Solutions Corp, a digital currency equipment supply chain service. On October 21, AGM sold 25,000 ASIC miners to Minerva Semiconductor Corp. Furthermore, AGM revealed a partnership with Meten Holding Group, a Nasdaq-listed English language coaching firm that is based in China.

The partnership announcement caused Meten Holding Group’s stock (Nasdaq:METX) to soar in value, increasing over 44% on October 28. On that day, METX was swapping for $0.5990 per share and today, METX is changing hands for $0.62 per share. AGM’s shares on Nasdaq, AGMH, were swapping for $11.40 per share on November 5, and each share has gained 3.771%, now trading for $11.83 per unit.

What do you think about the relatively unknown mining rig manufacturer stepping into the bitcoin mining industry? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, AGM Group Holdings

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Be the first to comment