Key Takeaways

Approximately 36 whales have joined the FTT network over the past three days.

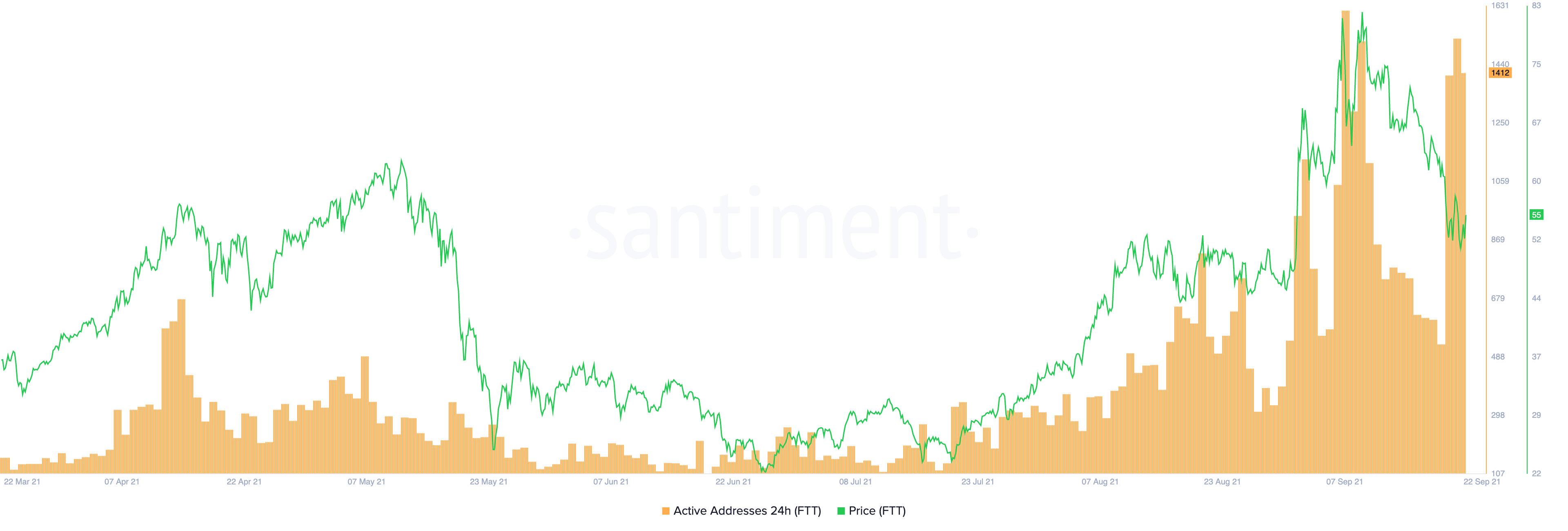

Additionally, more than 1,400 addresses are now interacting with FTT tokens daily.

As the network grows exponentially, prices could soon catch up.

Share this article

The FTX exchange token FTT has seen an increase in network activity over the past few days after it was revealed that CEO Sam Bankman-Fried is welcoming regulation with open arms.

FTT Whales Buy En Masse

On Sep. 20, subsidiaries of the cryptocurrency exchange FTX in Gibraltar and the Bahamas received licenses to operate within both nations’ regulatory frameworks. FTX CEO Sam Bankman-Fried said that the company is “committed to maintaining a close working relationship with local regulators” to promote the growth of cryptocurrencies worldwide.

FTX’s token, FTT, saw a significant spike in network activity following the regulatory green light. It appears that large investors have rushed to add more FTT to their portfolios.

Santiment’s holder distribution chart shows that the buying pressure behind FTT rose dramatically over the past three days. The behavioral analytics firm recorded a significant increase in the number of addresses holding millions of dollars worth of FTT, colloquially known as “whales.”

The number of addresses holding 10,000 to 1,000,000 FTT rose sharply. Roughly 36 new whales have joined the ranks of the top FTT holders, representing a 30% increase in a relatively short period.

The recent increase in the number of large investors may seem insignificant at first glance. Still, when considering that the average whale hold between $560,000 and $56 million in FTT, a sudden spike in buying pressure can translate into millions of dollars.

Network Activity Explodes

Similarly, the number of active FTT addresses has surged exponentially in the last few days. Roughly 1,440 addresses have interacted with FTT tokens over the past 24 hours, representing a 172% jump since Sep. 19.

Such a sudden increase in the number of active wallets can be seen as a positive sign since it has led to rising prices in the past.

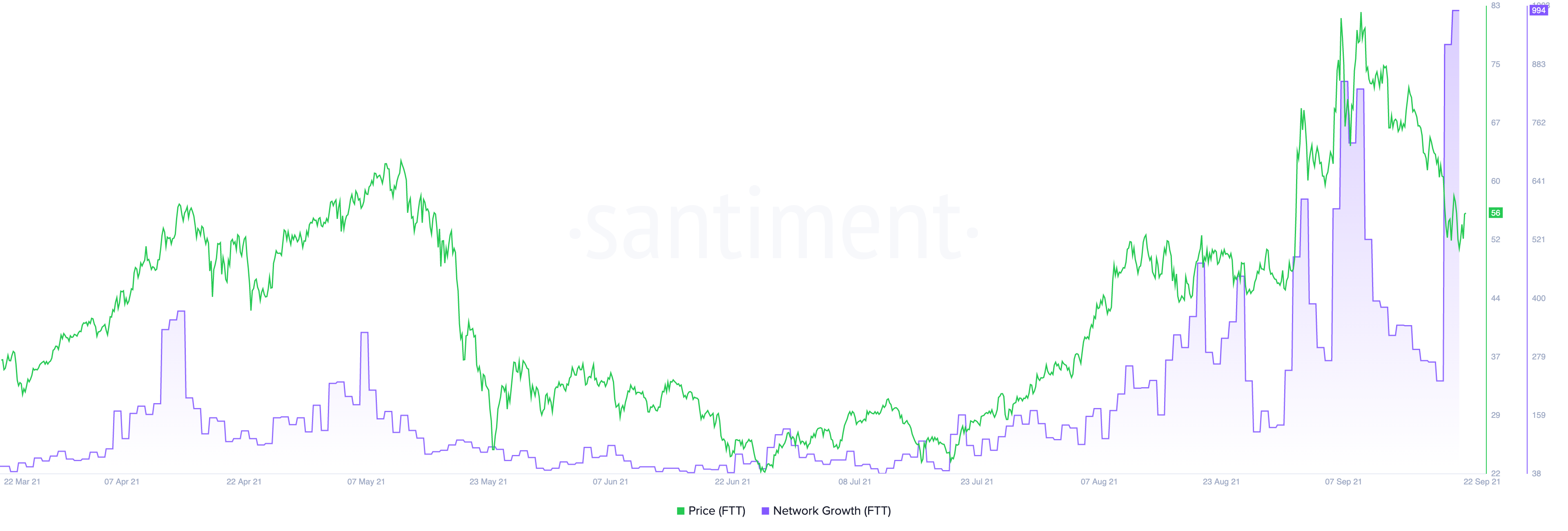

The bullish thesis is further corroborated by network growth, which has skyrocketed to a new all-time high.

This on-chain metric is often considered one of the most accurate price predictors. Generally, a steady increase in the number of new addresses that transferred a given token for the first time leads to rising prices.

These three on-chain metrics suggest that FTT might be preparing to resume its uptrend over the next few weeks. Even though prices have taken a 44% nosedive since Sep. 9, the rising activity on the network points to a v-shaped recovery toward new all-time highs.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

FTX’s NFT Listing Service Disrupted by Fish

Leading crypto exchange FTX has launched an NFT listing service. However, due to a large number of spam submissions, the exchange is now charging a $500 fee. Users List NFTs…

Liquid to Cover Hack Losses With $120M Loan From FTX

Liquid has closed a $120 million debt financing round from FTX. Liquid Receives FTX Bailout Japanese crypto exchange Liquid Global has raised $120 million in debt financing from fellow exchange…

FTX Buys Naming Rights to Another Sports Venue

The deal is FTX’s latest big move in a series of partnerships with sports organizations. Enter FTX Field FTX, one of the top cryptocurrency exchanges in the industry, has struck…

How to Trade Using the Inverse Head and Shoulders Pattern

In stock or cryptocurrency trading, you may have heard of the term “inverse head and shoulders.” Also known as the “head and shoulders bottom” formation, the inverse head and shoulders chart pattern can…

Be the first to comment