Key Takeaways

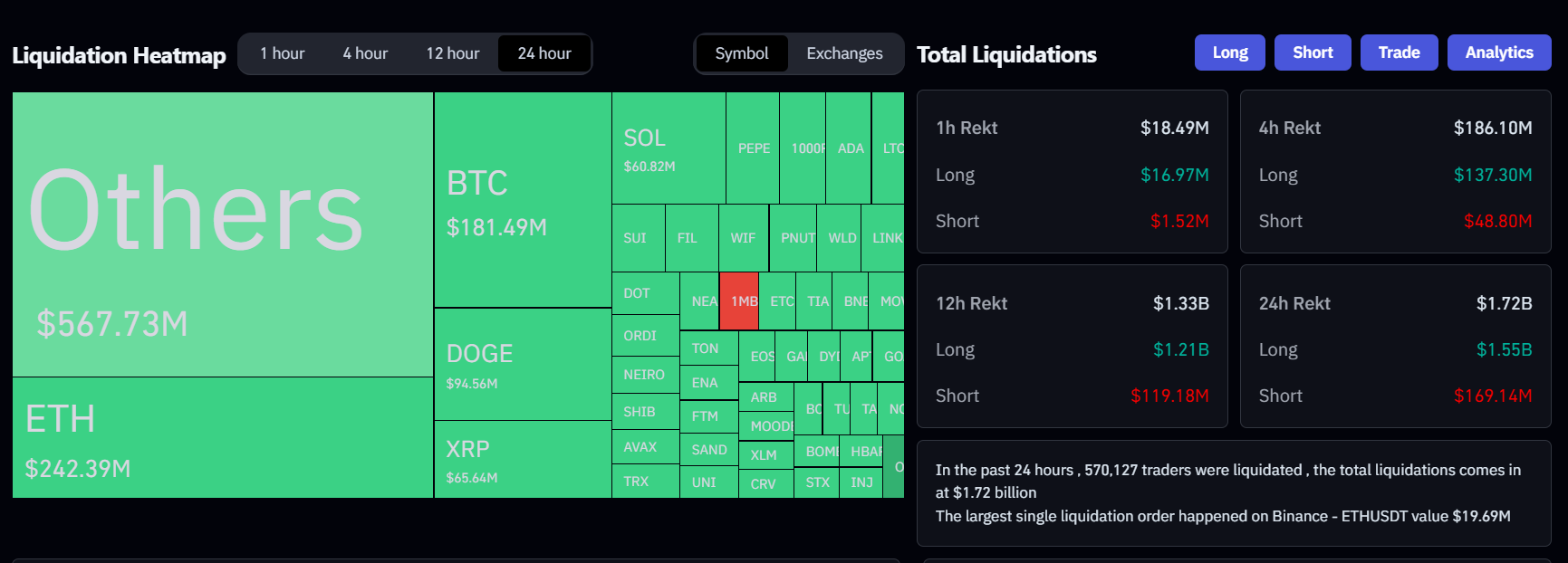

The crypto market crash led to $1.7 billion in leveraged position liquidations within 24 hours.

Despite concerns over quantum computing’s impact on crypto security, current threats remain minimal.

Share this article

A sharp crypto market correction triggered $1.7 billion in liquidations over 24 hours, with Bitcoin falling from above $100,000 to $94,100 and Ethereum dropping 8% below $3,800, according to data from Coinglass.

The market-wide selloff led to $168 million in short liquidations and $1.5 billion in long positions being liquidated, as the overall crypto market cap shrank by 7.5%.

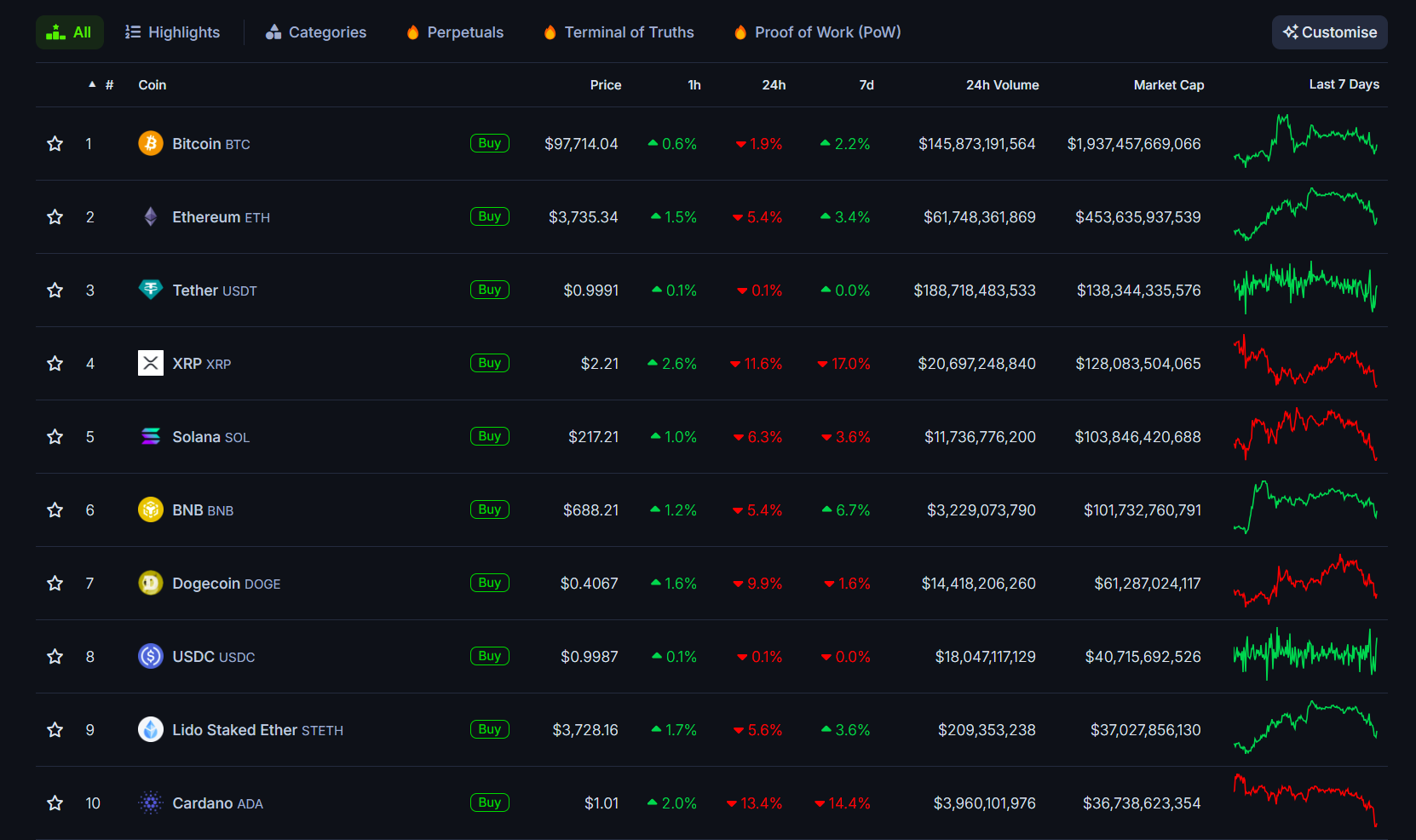

Bitcoin has partially recovered from its recent dip, now trading at $97,800, but remains 2% lower over the past 24 hours. The rest of the crypto market, however, is still under pressure. Most altcoins have plummeted by at least 10% within a day.

Of the top 10 crypto assets by market cap, Ripple (XRP), Dogecoin (DOGE), and Cardano (ADA) bore the brunt of the losses. XRP declined by 11%, DOGE by 10%, and ADA by 13%.

While no single event has been definitively identified as the cause of Monday’s pullback, crypto traders speculate that a combination of factors, including Google’s release of the ‘Willow’ quantum computing chip and recent Bitcoin transfers from Bhutan, may have played a role.

Bhutan moves 406 BTC to QCP Capital

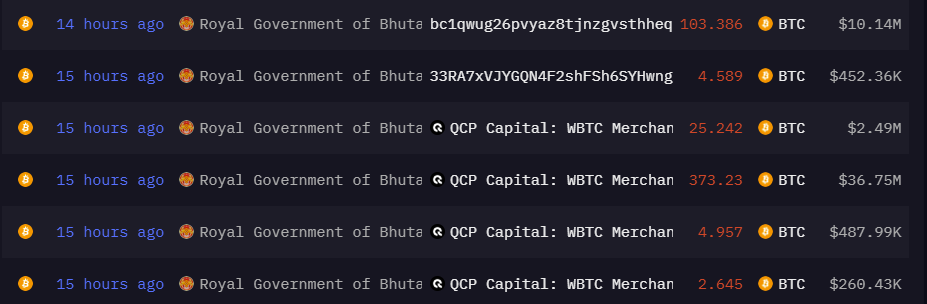

A wallet controlled by the Royal Government of Bhutan transferred 406 Bitcoin to QCP Capital, a Singapore-based digital asset trading firm, earlier today, data from Arkham Intelligence shows.

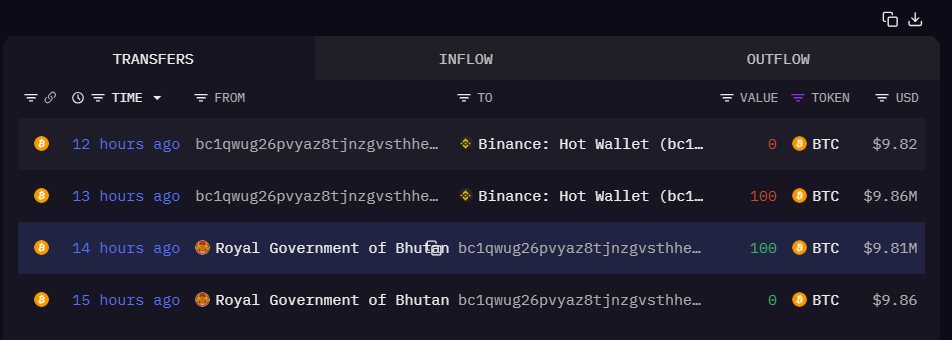

The transfer was split into several smaller transactions. Following these, Bhutan made another Bitcoin transfer worth $19 million to an unidentified address starting with “bc1qwug2.” These funds were then moved to a Binance hot wallet.

The reason behind the government’s wallet activities is uncertain. Last month, Bhutan reportedly sold 367 Bitcoin for approximately $33.5 million via Binance. Bitcoin’s price fell below $90,000 following the move.

Despite recent sales, Bhutan remains one of the top five government holders of Bitcoin worldwide, with a current reserve of 11,688 Bitcoin, valued at nearly $1.1 billion. Unlike most countries that acquire Bitcoin via asset seizure, Bhutan mines its Bitcoin using hydroelectric resources.

Google’s quantum breakthrough

On Monday, Google rolled out a new quantum chip called ‘Willow.’ Hartmut Neven, Founder and Lead of Google Quantum AI, said the chip can complete tasks in under five minutes that would take the fastest supercomputers about 10 septillion years.

Developed by Google Quantum AI and demonstrated superb error correction capabilities with increased qubits, this breakthrough points towards scalable quantum computing.

A number of crypto community members expressed concerns about the chip’s potential threat to Bitcoin’s security as soon as it was revealed. There is concern that hackers could break the encryption protecting crypto wallets and exchanges as computing power increases.

“$3.6 trillion of cryptocurrency assets are, or soon will be, vulnerable to hacking by quantum computers,” wrote a community member.

“My fringe theory is that #Bitcoin will eventually be hacked, causing it to become worthless,” said AJ Manaseer, manager of RE PE investment funds. “This new quantum chip did in 5 minutes what supercomputers today would take 10^25 years to accomplish. What does that kind of computing power do to cryptography? It kills it.”

However, many point out that while quantum computing is progressing rapidly, it’s not yet at a stage where it poses a serious threat to Bitcoin’s security.

“Estimates indicate that compromising Bitcoin’s encryption would necessitate a quantum computer with approximately 13 million qubits to achieve decryption within a 24-hour period. In contrast, Google’s Willow chip, while a significant advancement, comprises 105 qubits. We have a way to go,” explained Kevin Rose, partner at True Ventures.

Ben Sigman, a Bitcoin entrepreneur and advocate, said that breaking ECDSA 256, a type of Bitcoin encryption, would require a quantum computer with millions of qubits, far surpassing Willow’s current capabilities.

“SHA-256: Even tougher—requires a different approach (Grover’s algorithm) and millions of physical qubits to pose a real threat,” he added. “Bitcoin’s cryptography remains SAFU… for now.”

Share this article

Be the first to comment