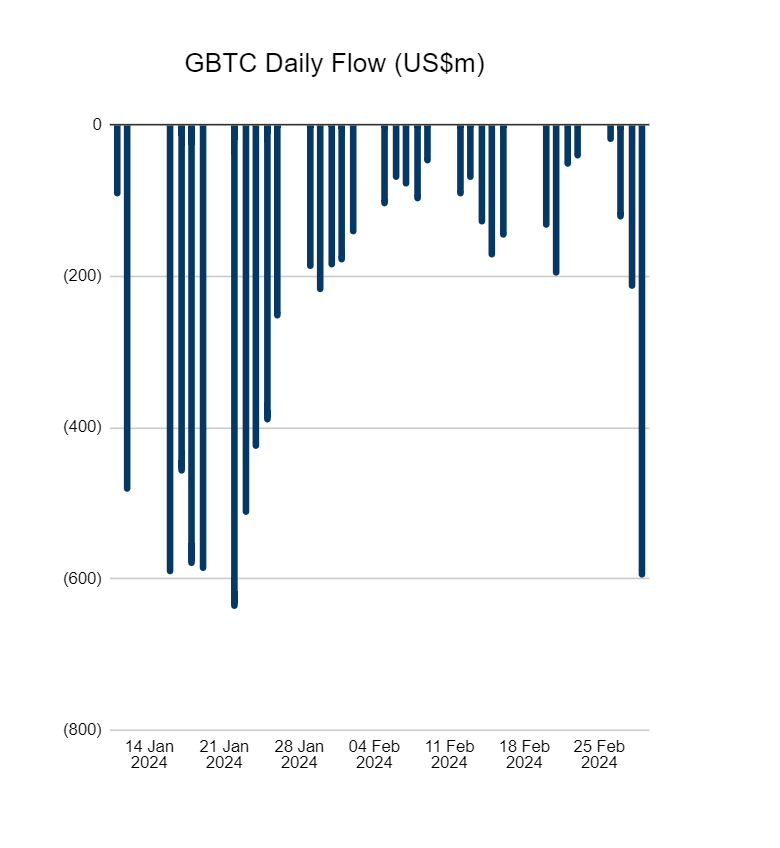

Grayscale Investments lost $8.4 billion from the Grayscale Bitcoin Trust (GBTC) since converting it to an exchange-traded fund (ETF) on January 11, 2024. The outflows come as investors eye new products from banks and other financial institutions.

Yesterday’s outflows from the GBTC fund totaled almost $600 million, making February 29 the second largest day of outflows since the US Securities and Exchange Commission approved the ETF. Net outflows from the Grayscale fund now total approximately $8.4 billion.

Grayscale GBTC Records Outflows as Competition Heats Up

The outflows from Grayscale coincide with increased demand for exchange-traded products from other providers. While investors pulled $610 million from Grayscale alone last week, this was accompanied by inflows of $436 million into other US Bitcoin ETFs. Moreover, more institutions are offering crypto-related funds.

Yesterday, reports surfaced of US banks Wells Fargo & Co and Bank of America launching spot Bitcoin exchange-traded funds for wealth management clients. Early this week, news surfaced of another Wall Street giant, Morgan Stanley, expressing interest in a spot in Bitcoin ETF.

More crypto-focused firms like Coinbase and Ark Invest could soon launch ETFs for other cryptos like Ripple (XRP), Ethereum (ETH), and Chainlink (LINK). Ripple’s CEO Brad Garlinghouse said he expects more funds to follow the launch of spot Bitcoin ETFs.

Read more: What Are Altcoins? A Guide to Alternative Cryptocurrencies

The first crypto ETF to follow the Bitcoin funds will most likely be products that track the price of Ethereum. While these were originally expected in May, Bloomberg analyst James Seyffart predicts they may only come later this year. Anticipation of the approvals has seen the ETH price skyrocket from $1,629 on September 1, 2023, to $3,436 at press time.

BeInCrypto requested comment from Grayscale on the outflows from its Bitcoin Trust but had not heard back at publication. Investors had previously suggested that the 1.5% management fee Grayscale charges for managing its Bitcoin fund was to blame for early outflows.

How ETFs Affect Demand and Supply

A side-effect of demand for ETFs that track the price of Bitcoin is the demand for more BTC. Miners produce roughly 900 BTC for correctly solving the hashes of transaction blocks. Blockchain hashing imbues a transaction block with a unique fingerprint that miners must guess.

When demand for ETFs is high, authorized ETF participants inform the issuer. The issuer will then create new ETF shares and buy Bitcoin to back up their shares. Intuitively, they will redeem shares and sell Bitcoin when there is less demand.

Issuers’ BTC purchases can use up coins that are being freely traded on the open market. But until miners add to the circulating supply by selling coins they mine, the only assets available on the open market will be those that other funds or traders are willing to sell. As a result, ETF issuers may face a temporary shortage if no one is willing to sell the amount they need to meet demand.

Read more: What Is Bitcoin? A Guide to the Original Cryptocurrency

In a recent interview with CNBC, Matt Hougan of Bitwise Asset Management described this dynamic. He said the new demand from retail investors, institutions, and advisers is outstripping the rate at which new coins enter the market.

“There’s simply this massive supply/demand dynamic going on. Net new demand and a fixed supply and…a reduction in new supply coming up in April with the halvening…With Bitcoin right now, its just about supply/demand, and there’s too much demand and not enough supply,” Hougan said.

The Bitcoin halving or ‘halvening’ is a quadrennial event during which the Bitcoin software will reduce the number of BTC mined daily from 900 to 450. This reduction will introduce an additional supply shock. According to Hougan, expecting Bitcoin to reach $200,000 may not be unreasonable.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment