The famous author of the best-selling book Rich Dad Poor Dad, Robert Kiyosaki, has revealed why he is buying more bitcoin. He warned that the Securities and Exchange Commission (SEC) regulations will “crush” most other cryptocurrencies.

Robert Kiyosaki Buys More Bitcoin, Warns About SEC Regulations Crushing Crypto Tokens

The author of Rich Dad Poor Dad, Robert Kiyosaki, has revealed the key reason why he is investing in bitcoin. The famous author warned that the Securities and Exchange Commission (SEC) will “crush” most other crypto tokens with its regulations.

Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

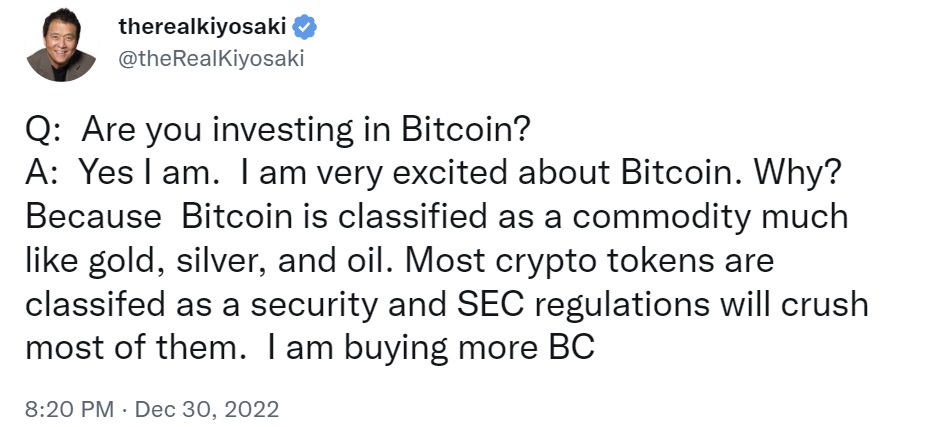

Kiyosaki tweeted Friday that he is investing in bitcoin. He explained that he is “very excited” about BTC because the cryptocurrency “is classified as a commodity much like gold, silver, and oil.” The Rich Dad Poor Dad author added that the U.S. Securities and Exchange Commission (SEC) has classified bitcoin as a commodity while most other crypto tokens are securities, cautioning that “SEC regulations will crush most of them.” He ended his tweet by stating that he is buying more bitcoin.

SEC Chairman Gary Gensler has said repeatedly that bitcoin is a commodity while most other crypto tokens are securities. The chairman of the Commodity Futures Trading Commission (CFTC), Rostin Behnam, has also confirmed that bitcoin is a commodity.

The securities regulator said in November that its Enforcement Division remains focused on crypto. The SEC has been heavily criticized for taking an enforcement-centric approach to regulating the crypto sector. Gensler said in May following the terra/luna collapse that a lot of crypto tokens will fail.

The Rich Dad Poor Dad author has been recommending investors buy gold, silver, and bitcoin for quite some time. Kiyosaki previously said he is a bitcoin investor, not a trader, so he gets excited when BTC hits a new bottom.

Earlier this month, he predicted that bitcoin investors will get richer when the Federal Reserve pivots and prints trillions of “fake” dollars. Following the collapse of crypto exchange FTX, Kiyosaki said he is still bullish on bitcoin, emphasizing that crypto cannot be blamed for the FTX meltdown. In September, the renowned author urged investors to get into crypto now, before the biggest market crash strikes.

Kiyosaki also made other dire predictions, including the U.S. dollar crashing, the Fed destroying the U.S. economy with its rate hikes, hyperinflation, a Greater Depression, and World War III.

What do you think about Robert Kiyosaki buying more bitcoin and his warning that SEC regulations will crush most cryptocurrencies? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Be the first to comment